Positioning Watch – Are markets ready for Powell Wednesday?

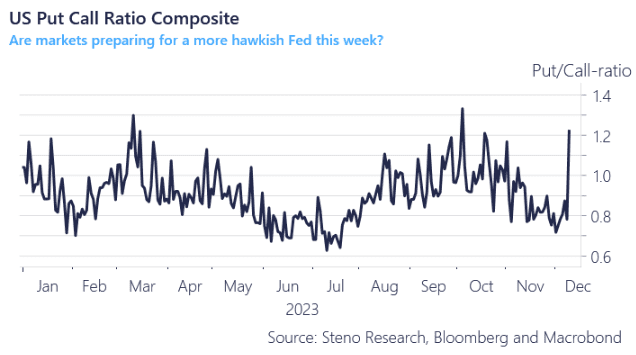

With Powell taking the stage on Wednesday, likely turning more hawkish in his rhetoric after weeks of financial conditions easing, we have had a look at if we are starting to see signs of markets reversing their ultra-bullish positioning.

In general markets have taken a bit of a breather from a positioning perspective after the historically bullish sentiment seen throughout November, and people are now starting to hedge their longs based on recent option volumes, with the aggregate US intraday put-call ratio now back solidly above 1. Looks like traders are starting to hedge their equity bets going into the central bank bonanza this week.

Chart 1: Intraday put-call ratio suggests that risk-aversion has returned

Financial conditions have eased substantially since the last FOMC meeting in November. Are markets prepared for hawkish rhetoric? We explore the data.

0 Comments