Portfolio Watch: The Yellen Put

ello, everyone, and welcome back to our weekly Portfolio Watch, where we take a look at the current state of the market and our own positions in the game!

It’s becoming increasingly clear that the Treasury is going to be front and center in 2024. The market’s response to the QRA last quarter seems to have marked a turning point, coinciding with the bull run in risk assets. However, this year has seen a reversal of the dovish sentiment in rate swaps, which has taken some wind out of the sails of last year’s exuberant bull market.

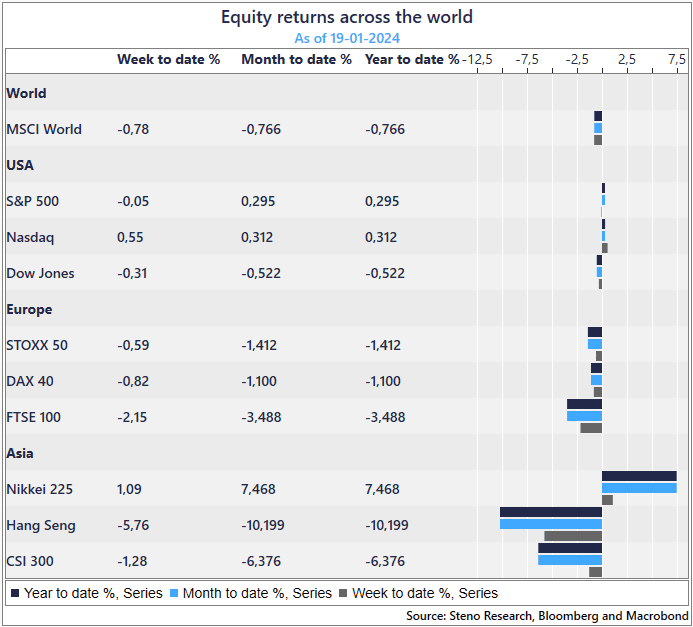

The journey for risk assets this year has been a bit bumpier, but it’s worth noting that US risks, especially the big tech companies, have continued to perform well. At the same time, the Dollar has shown resilience, and long yields have risen from their lows.

Meanwhile, the growing divergence between the NIKKEI and the Chinese market, which appears to be in a severe downturn continues relentlessly

Chart 1: Equity Returns Globally

But what’s happening with US risk assets? As we previously mentioned…

Powell had his fun in December and now Yellen is preparing her next move. Here is how we play it

0 Comments