Portfolio Watch: Inflation DIVERGENCE is growing

Morning from Europe with low activity across markets due to Easter Friday. Our daily coverage returns on Tuesday (including Something for your Espresso dailies).

The inflation evidence from Europe has been extremely soft this week and it rhymes VERY well with our tactical view of much wider USD-EUR inflation spreads. The softening inflation currently allows for a major “catch-up” effect in European (and to certain extent Asian) risk assets, and indices such as DAX and Nikkei have moved a few sigmas away from short-term fair values consequently.

Is this the European “pivot-moment” allowing for animal spirits chasing the rate cutting cycle as was the case in the US in Q4 and early Q1? Let’s have a look at the four themes of major relevance to your portfolio right now!

Theme 1: Inflation divergence

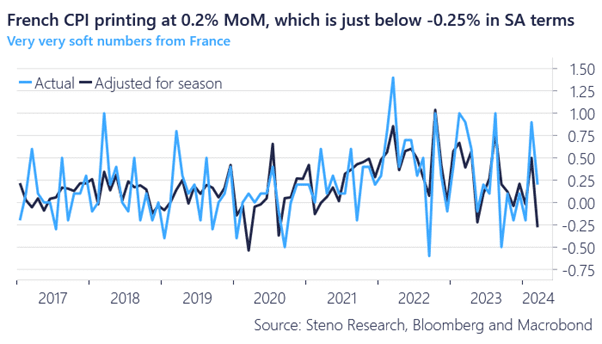

French inflation printed even softer than our already VERY soft now-casts with the MoM rate and given that March is typically a “hot” inflation month, the seasonally adjusted numbers make for extremely dovish reading. The same was the case in Italy, where HICP inflation printed at 1.2% MoM, below the full forecast range (and below our soft estimate of 1.4%).

We have been banging the drums on such disfinflationary/deflationary surprises in the Eurozone since early this year and we are finally getting some bang for the buck here.

A print of 0.2% MoM in the French CPI index in March equals almost -0.3% MoM adjusted for seasonality. This is the softest inflation report since before the pandemic from France!

Chart 1: A VERY soft inflation print from France

The inflation divergence theme is growing in importance, while the Rest of the World is catching up (or down) to the US in terms of financial conditions. Here is how we position for it..

0 Comments