Portfolio Watch: How we play the last FOMC meeting of 2023

Hello Everybody and welcome back to yet another Portfolio Watch!

This week we have managed to secure significant profits in EUR duration but faced setbacks in the Energy longs, but overall we have been doing well and are content with our batting average.

We have been banging the drum on a last cyclical upswing for 2023 in December as we thought November too should prove to surpass expectations and last into the new year. Has the data been supportive thus far?

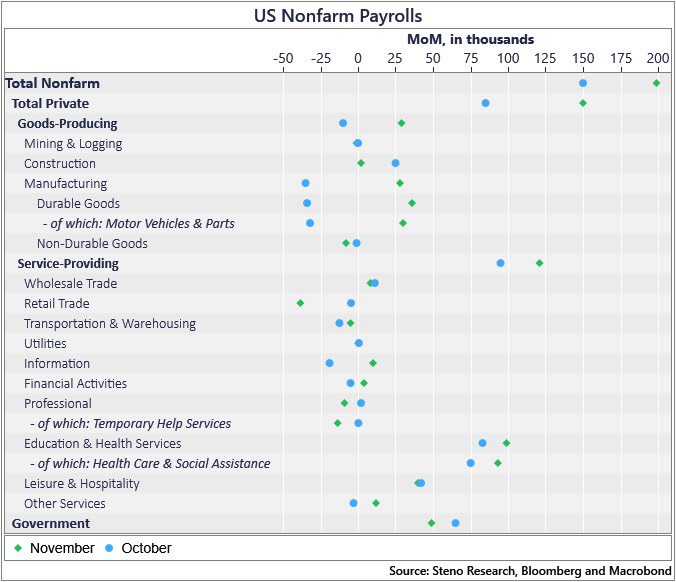

Largely yes. The latest Non-Farm Payroll from November clearly shows that employers have not thrown in the towel yet. Despite 2023 being one of gradual easing of the labor market, November still marks a notch to the tight side with Unemployment edging lower ( from 3.9% to 3.7%) while the participation rate staying somewhat stall.

ISM Manufacturing is still looking gloomy but the Service ISM did come in on the hot side. Something that is reflected in today’s NFP report:

Chart 1: Non-Farm Payroll, US

We have made adjustments to our portfolio in preparation for the FOMC decision week,. Read our full take of the current macroeconomic landscape and see our new positions below

0 Comments