Portfolio Watch: Data green-lighting continued rally – cautious metals however

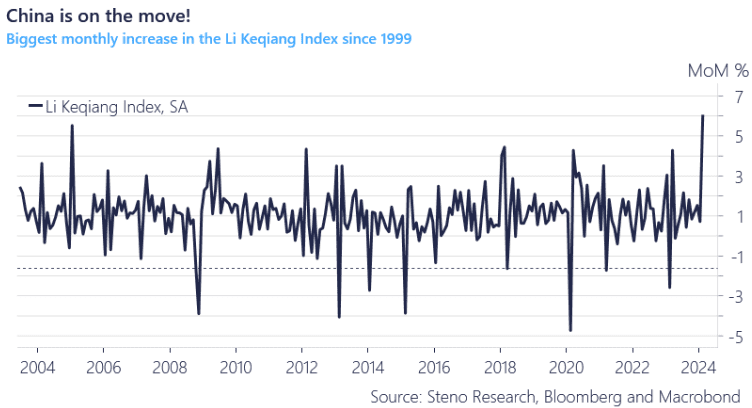

Our early conviction in pro-cyclical trends keeps getting confirmed. Initially, our nowcast indicator for China signaled a positive outlook, and most notably this week, the Li Keqiang Index has experienced its strongest monthly surge since 1999.

Consequently, Asian currencies and the AUD still appear undervalued when compared to the early yet unfolding expansion outside the US. An expansion to the EZ first supported by the ZEW survey and confirmed with today’s beats across components in the German IFO.

Our positive forecast for a further upturn in cyclical activities remains intact, solidifying our confidence in our short positions in USDSEK despite lagging performance recently.

Fundamentals still speak to long exposure in currencies such as the AUD, MYR and THB against a selection of European peers, and we favor Asian and Oceanian currencies against European FX broadly – A persistent macro-trend through 2024, which our PCA model confirms, and a trend we currently see no immediate reversal to.

Chart 1: Data supporting our early indications on China

China has been in the limelight recently, and the attention from clients match the evident rotation in managed positioning. While tremendously yielding, we’ve decided to de-risk in metals but keep overall cyclical exposure.

0 Comments