Portfolio Watch: Celebration for the right or wrong reasons?

The Fed was ‘navigating by the stars under cloudy skies’, but now markets have implicitly been allowed a go. The provisional result? Rally in bonds and a subsequent rally in equities.

In this week’s Portfolio Watch, we’ll have a closer look at the reasoning behind the move lower in yields and whether they are a sign of misalignment between hopes and expectations versus still lingering suboptimal fundamentals. We also try to gauge whether the recent weakness in the USD will continue, and its link to the manufacturing cycle.

As always, we run through this week’s leaders and laggards in our portfolio and offer our thoughts on where to find value under current circumstances.

Key takeaways:

- The USD weakness is the first sign of…

Is the USD about to reverse towards a negative trend?

This is going to be the key question for global macro from here. Our forward looking assumptions worked with January as a likely timing for that sharp reversal of the USD and 2024 as a strong cyclical year in FX. It may be that it happens a bit sooner here.

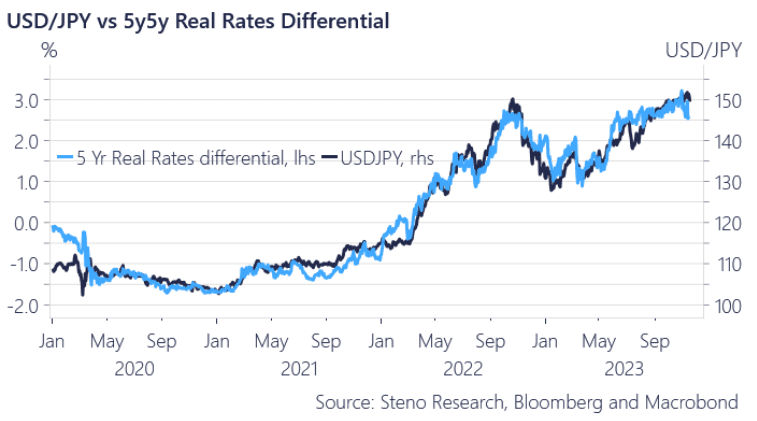

Now that the first evidence of cracks in the US economy seem to appear, USD real rates have started to narrow versus peers. USDJPY real rate fair value is currently below 150 compared to 155 a month ago, and now that USDJPY is on the move, it is safe to say that the unwind of the USD exceptionalism longs have begun.

Let’s see how far this can go. Reading 2024 outlooks, every single IB is still long this narrative in their thinking.

Chart 1: Moves in rates have flipped JPY fair value <150

A softer than anticipated CPI print – spot on our forecast – lit the fuse for a rally in equities following a rally in bonds. Whether yields eased for the right reasons remains unclear. Read along as we dissect the moves, our performance and consider our allocations going forward.

0 Comments