Portfolio Watch: Any juice left in the anti-Europe bet?

Welcome to our weekly portfolio watch! In this piece, we look at the developments in our portfolio and try to assess the risk/reward in current markets.

Earlier this week, we received the monthly fund manager survey, and it seems like Energy remains underweight relative to benchmarks despite the recent performance.

Managers are also underweight equities in both Europe and the UK relative to benchmark allocations, while they also expect the Chinese economy to weaken further. The change in sentiment around China is absolutely remarkable in the survey, from a big consensus long in Q1 to a big consensus “no-go” in Q3.

European consensus is getting crowded around the recession-narrative. Rates expectations have fallen off a cliff in the ZEW, meaning that investors are now betting on peak rates from the ECB around the corner. Is the long bond case getting crowded again?

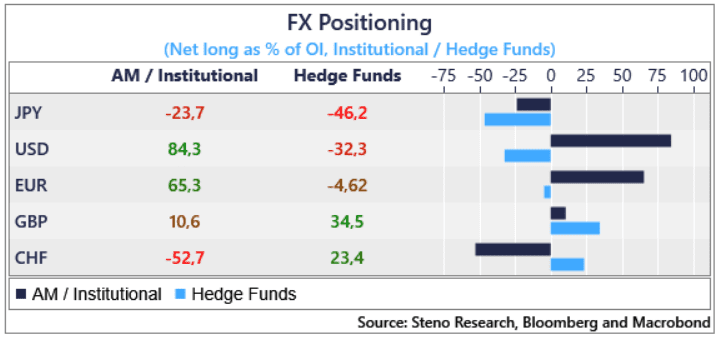

In FX space, we note how the GBP long is still material among both AMs and HFs meaning that we continue to like our Cable shorts despite the cross being in oversold territory.

Chart 1: GBP a net long case in both AM and HF space

The short Europe bet is getting increasingly crowded but for good reasons, while the energy bet, impressively, is not overly crowded yet. That is comforting for EUR shorts as energy is a main driver of European versus US allocation.

0 Comments