Portfolio Watch: Aboard the train but starring at the emergency exit

Hello Everybody and welcome back to our weekly book update!

As we laid out last week our hands are up in the air long everything like we just don’t care- except bonds. The reason is that the existing regime we were left with late last year with liquidity stacking up and growth fueled by Bidenomics remains fairly accommodative for risk assets while the debt issuance the treasury is burdened with these days is keeping a floor on the yields.

What we have been pondering of late is whether the enduring inflation risk we’ve flagged will be accompanied by a corresponding persistence in growth.

And boy did we get an answer this week. With economist consensus pointing to a 2.0% QoQ annualized figure for Q4, we ended up at… 3.3%.

That was the last domino in our view to accept that we are not just trading US price pressure from here but the slow repricing of growth is probably not done

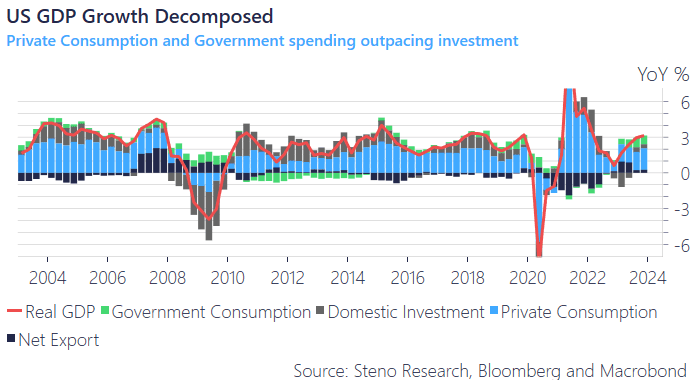

Chart 1: US GDP Decomposed (YoY)

Sticky prices and high growth appears to be the winning combination to bet on, and this week’s data undoubtedly reaffirmed that. Read below for our full take!

0 Comments