Liquidity & Treasury Watch: The ramifications of the quarterly refunding report

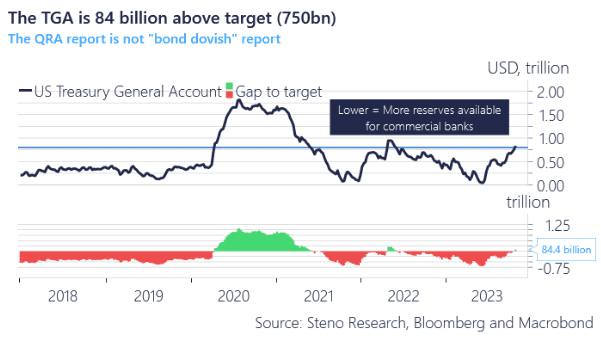

The quarterly refunding report from the US Treasury was far from the issuance-bazooka that some had expected. There was no move in the target for the Treasury General Account either as we had expected, but it is not a reason to celebrate for bond bulls anyway. Let’s have a look at the details and the consequences for USD liquidity.

A few highlights from the Quarterly Refunding Statement

“During the October – December 2023 quarter, Treasury expects to borrow $776 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $750 billion.”

“The borrowing estimate is $76 billion lower than announced in July 2023, largely due to projections of higher receipts somewhat offset by higher outlays.”

“During the January – March 2024 quarter, Treasury expects to borrow $816 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $750 billion.”

For reference, the US Treasury borrowed a tad more than a trillion in Q3.

Chart 1: The TGA is already above target levels

The quarterly refunding report will likely allow the Fed to be hawkish for longer as the liquidity outlook is decently benign, while the bond-zooka was avoided (for now). Find the details here.

0 Comments