Labor Market Watch: The final nail in the Coffin?

Welcome to this concise and chart-dense edition of the ‘Watch Series’ where we’ll have a closer look at the US labor market. While the Fed’s dual mandate obligates them to ensure both price stability and maximum employment, last year has clearly shown that upholding both can be tricky – especially when price stability is under pressure largely due to the record low unemployment.

Main take-aways up front:

- Close to all timely indicators show …

Let’s turn to our charts

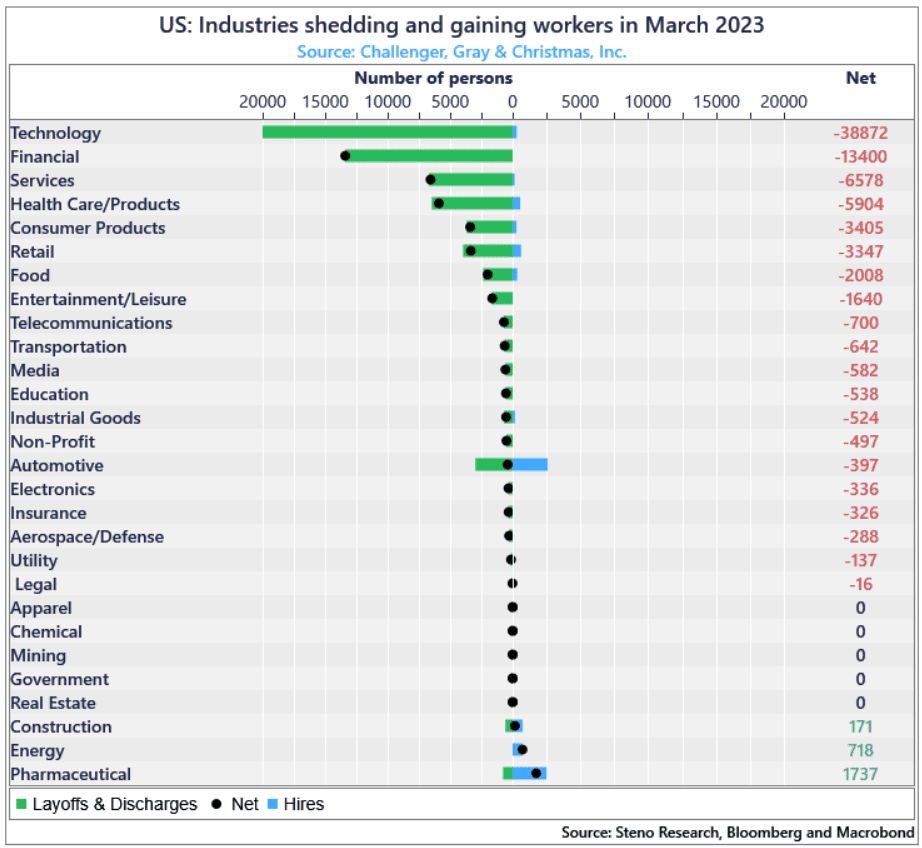

Looking at net hires in March, it becomes evident that the strict monetary policy has fed through parts of the economy and is now affecting the notoriously lagging labor market. The technology sector is, by some margin, topping the chart, rapidly shedding workers. The likes of Amazon, Alphabet, Facebook etc. were onboarding at an outrageous pace throughout covid and in the immediate aftermath. On average they nearly doubled their headcount. Then, it is not that surprising that some abundance – we’ve all seen the HQ tour videos going around on social media – is being laid off.

Besides tech, sectors such as financials, services and health care/products are all dialing down their workforce. A development we expect to continue, and a development indicating that the economy is actually headed in the right direction.

Chart 1: Layoffs and discharges are on the rise

The unwavering strength of the labor market has backstopped the probability of a classic recession, but is data now finally beginning to show what we have all predicted?

0 Comments