Japan Watch: The Flight Back Home

“Either you do Japan, or else Japan will do you” – Anonymous Danish Fixed Income PM

Welcome to this Japan-focused edition of the ‘Watch-series’. Being the second-largest developed economy and – with $3.31 trillion in net external assets (2021) – the world’s largest creditor for 31 consecutive years, it is bound to catch one’s attention, when things begin to stir and even actually move in Japan. As it too is the largest net lender on earth, every single fixed income manager on the planet ought to be on their toes with regards to the potential scrapping of yield curve control in Japan and the corresponding ramifications.

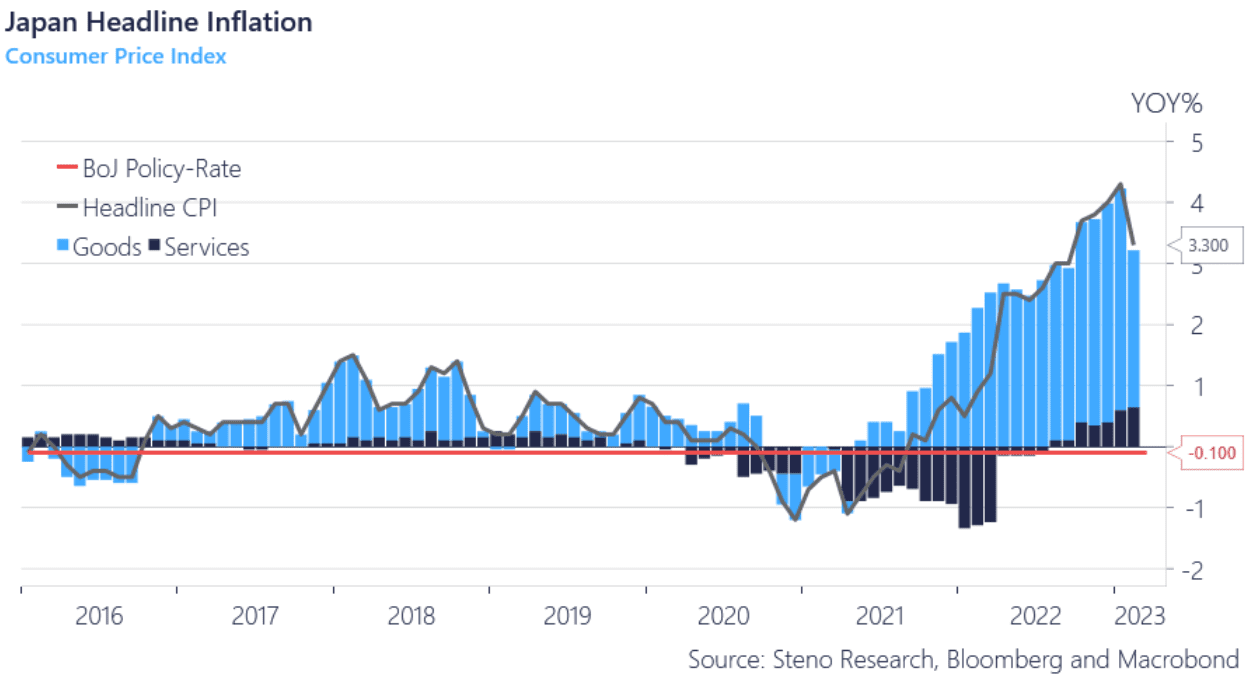

One of BoJ’s biggest responsibilities has been to get Japan out of its deflationary regime. Something they have suffered under for the past decades. That wish has now come true, but the latest headline CPI reading came in at 3.3%, which is still too elevated for comfort. Mullings of alterations to the current policy have been going around, but will this be the trigger for BoJ to exit its ultra-loose stimulus program and drop the yield-curve-control? Whether curve control will be dismissed entirely or the band will once again be widened we cannot say, but the current policy rate isn’t sustainable.

Chart 1: Be careful what you wish for

Japan remains a MUST watch as a risk taker in the West. With the potential scrapping of the YCC policy and the recent recall of capital to domestic markets, could this be a potential time bomb for Western markets? Here is how we monitor the situation.

0 Comments