Fed Watch: 25bps that they will woefully regret

It is Fed week and it is safe to say that they would have preferred to face the public at a more benign timing than right now.

We find the following to be the base-case now:

– The Fed will hike by 25bps to try and regain control of the narrative

– The Fed will soon thereafter admit to it being a mistake and communicate an end-date for QT

– Emergency cuts are in play already before the May meeting, if the crisis accelerates

– 200 bps worth of cuts to arrive before 2024

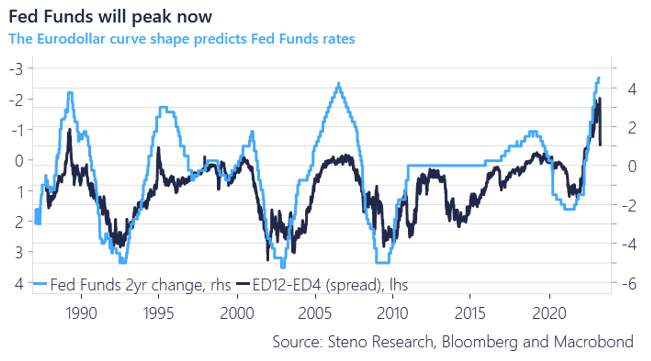

The Fed Funds rate is dictated by the Eurodollar curve shape and when markets scream loud enough, you better listen. Look at the ED4-ED12 spread as a predictor of Fed Funds. Given the most recent repricing of the Eurodollar curve, we feel very comfortable saying that rates will peak this Wednesday and cuts are likely to arrive sooner rather than later thereafter. We have very little insight into Fed’s thinking at the current juncture due to the blackout period, but given the vibes around the SVB depositor bailout, we’d argue that the Fed is still some way from throwing in the towel on the hiking plan(s).

Chart 1. Fed Funds will peak this Wednesday

The FOMC will likely decide to raise the Fed Funds target range by 25bps and regret it soon thereafter on Wednesday. Everything but the banking sector stress screams higher interest rates, why the Fed will attempt to regain control of the narrative.

0 Comments