Euro area watch: 7 charts on the ECB and EUR-inflation

I have finally had a few moments to digest the ECB meeting amidst stories that the Bank of Japan will tweak its YCC policy tomorrow. The macro environment never fails to entertain. Here is why the ECB will likely pause from here, while European inflation could reach target already by September/October.

There were two major changes to the communication from the ECB.

1) Policy is now 100% dependent on data, with no forward guidance as the following flavour was added to the statement. The ECB will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction (my brief translation of it). This is an explicit dovish move as it reveals that there is no consensus around hiking further.

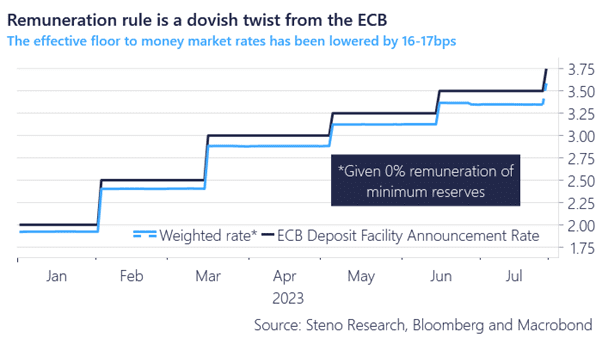

2) The 0% remuneration of minimum reserves instead of 3.75% (depo rate). The effective weighted remuneration of all EUR reserves drop from 3.75% to 3.58% based on the change to remuneration rules. This will move the floor on EUR money market rates lower relative to the depo rate as the money market floor is pretty neatly correlated to the weighted average of the remuneration of minimum- and excess reserves (see chart 1)

Chart 1: A sneaky dovish move by the ECB

The ECB is closer to pausing than the Fed and the clear headline mandate may allow the ECB to throw in the towel on the hiking cycle earlier than peers. Tomorrow’s inflation data is key. Here is our chart-package.

0 Comments