EUR Watch – The ECB will soon reveal their true inflation vs growth preferences

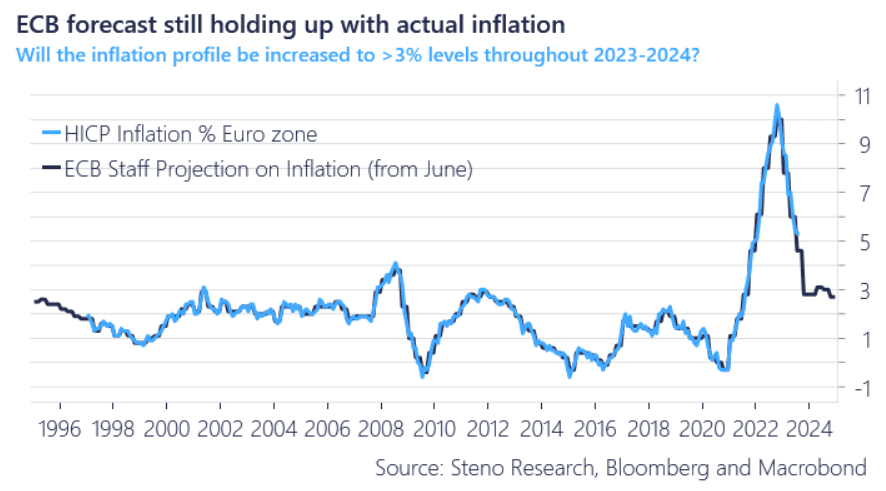

The ECB is likely going to hike tomorrow and even after the repricing this morning, we still see risk/reward favoring a bet on a hike. With the inflation forecast likely being hawked up (as per sources in Reuters), we see a very high probability that the ECB will react to the hawkish adjustment of staff projections with a hike and continued hawkish messaging.

If the ECB raises the inflation profile to >3% territory in Q4-2023 and Q4-2024, that would constitute a >0.3%-points increase in the profile, which will most certainly have to be followed up by policy action.

This will also be a confirmation that the ECB could not care less about growth as long as inflation is not contained.

Chart 1: ECB forecast to be hawked up?

We dive into the challenges ECB are (still) faced with, as headline inflation is likely to rebound from November and onwards, giving the ECB another – but bad – argument to keep policy restrictive. A hike seems like a done deal tomorrow, but what about the path for 2024?

0 Comments