Energy Cable: Melt UP in commodities upcoming?

Take aways:

- Booking profits in crude, staying long in broader metals

- Crude predicting ISM to turn in 6-9 months time

- Sluggish German IP ahead

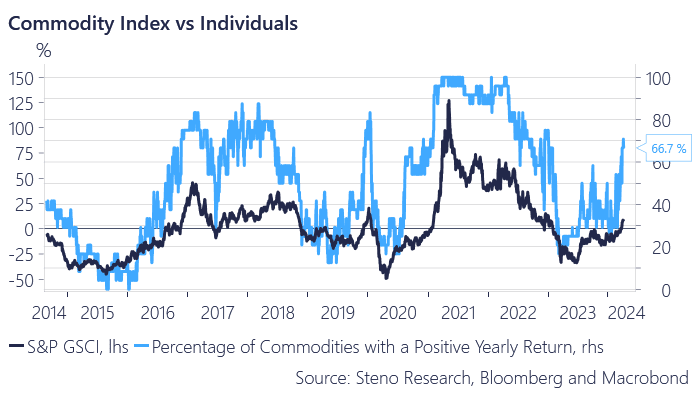

Last week, we reached our profit level in crude oil, leading us to exit the trade successfully. Our outlook remains bullish on commodities, spurred by what we perceive as a reflation head fake. This optimism has prompted us to enter a long proxy-position in the Bloomberg Commodity Index (BCOM), as we observe the rally widening across the commodity complex (Chart 1).

We have also entered a few trades in the metals space (both physicals and equities) as we continue to harvest returns in this space after a great run.

Chart 1: The rally becomes broader and broader

While we have booked profits in our long oil bets, we are getting increasingly bullish on the broader commodity complex. Especially a couple of metals look extremely interesting here.

0 Comments