Energy Cable: A new supply side crisis brewing in Nat Gas space?

The natural gas trade has started to move in recent weeks as the supply side looks constrained again. While the current situation doesn’t exactly mirror 2021, there are some similarities when we look more closely.

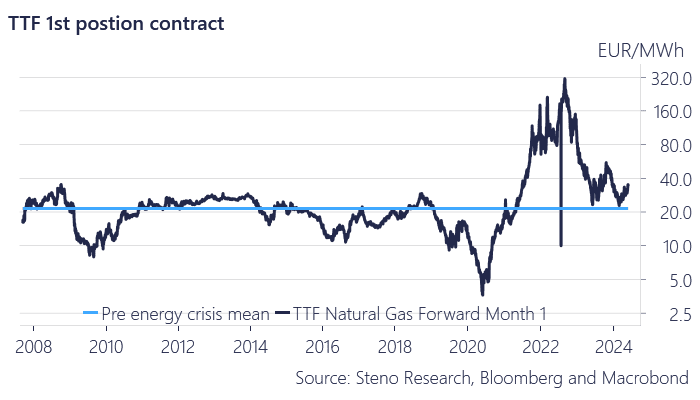

Firstly, given the new supply outlook post-energy crisis, we believe there are no fundamental reasons for TTF natural gas to trade in its pre-crisis range. Therefore, there should be a floor around the 25 EUR range. Entering a long position at these levels primarily exposes you to fast money accounts betting against you.

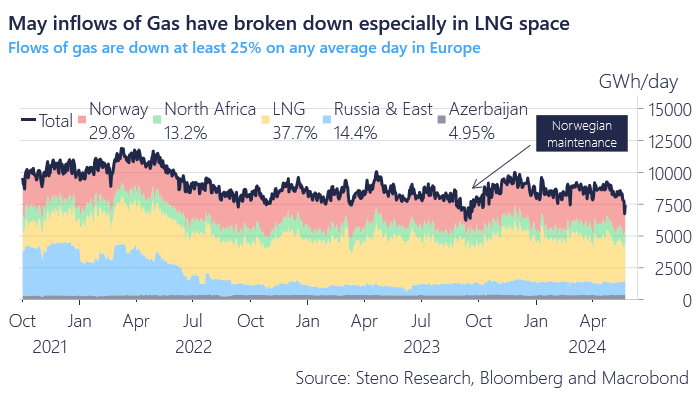

The supply side is currently looking weak for various reasons, and we have yet to fully consider the potential end of the Russian/Ukrainian gas deal by December this year or even earlier (which we find likely). On top of it, the Austrian oil and gas group OMV announced that gas supplies from Russia’s Gazprom may be suspended due to a foreign court ruling, but assured the market it has alternative sources to maintain supply. And we are obviously still dealing with the aftermath of the power outage at the Bintulu complex in Malaysia after a power loss on May 10, which resulted in an estimated loss of 240,000 tonnes of LNG.

It seems like a load of coincidental supply side factors, but there is rarely such a thing as a string of coincidences. Maybe there is a supply side story worth pursuing here?

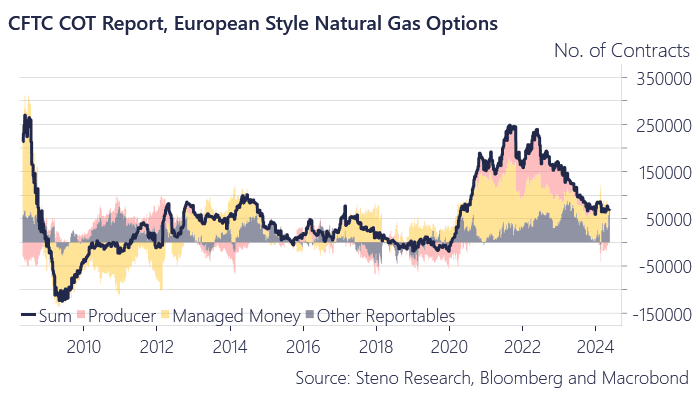

Chart 1.b: Longs still muted

Chart 1c: The 14% remaining supply from Russia is once again in jeopardy by year-end

We are once again long the mother of all window maker trades, but there are interesting moves to trade in the energy space again, as the supply side of Nat Gas (and Oil) is back in the lime-light.

0 Comments