Energy Cable #62: Biden is selling crude straddles, while something is cooking in China

Written by Andreas Steno and Ulrik Simmelholt

Last week we took healthy profits in some of our global reflation bets. We got out of silver and copper, but remain in the broad materials ETF. Data out of China is a bit unclear with some prints being bullish and others bearish and then ambiguous data points such as the BOOMING copper stock. The same goes for the Euro area where PMIs are rebounding from dreadful levels but high frequency data point in different directions.

What on earth is going on in China? Why is the copper stock booming? Have the Chinese authorities started prepping ahead of a supply side squeeze in copper space, is a major overhaul of the Chinese grid to accommodate the growing number of EVs on the cards in a fiscal package or has the physical need for copper disappeared and/or is the Chinese RE in an even worse condition than anticipated?

We probably subscribe more to the former than the latter explanations, but also see how speculative flows have bought copper aggressively on the back of the below chart. We await a softer price action to re-buy the Copper trend as it seems oversubscribed for now.

Chart 1a: Chinese copper stocks

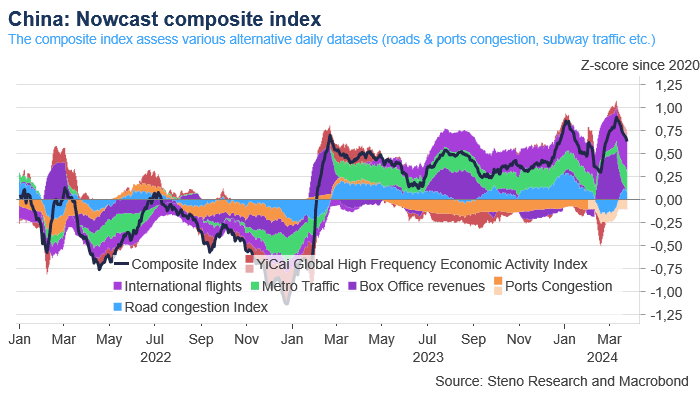

Chart 1b: Our Chinese nowcasts..

Chart 1b: Our Chinese nowcasts..

This week we hone in on the consequences of the Ukraine’s successful attacks on Russian refiners and how to play it along with some thoughts on our profit taking in metal space as something BIG is cooking in China!

0 Comments