ECB Watch: Trading the January lull

On inflation:

We have been covering EZ VAT technicalities over the last weeks here. Yesterday news out of Germany broke that the price reduction on train and bus tickets via the nationwide “Deutschland Ticket” will be continued beyond 1st of May and terminate at the end of this year. This will on a stand-alone basis worth 0.39% MoM in the German HICP and around 0.155% in the EUR HICP.

On top of that, French finance minister Le Maire confirmed that electricity costs will rise by 8.6-9.8% nationwide by the first of February in a televised appearance. This is LESS than penciled in by the ECB in the Q1-HICP forecast (15% was the increase in Feb-2023) and a little less than our projection of 10%. This basically confirms an overall trajectory of much fewer and less draconian increases in VAT rates in core Eurozone countries than feared by the ECB in the December staff projections.

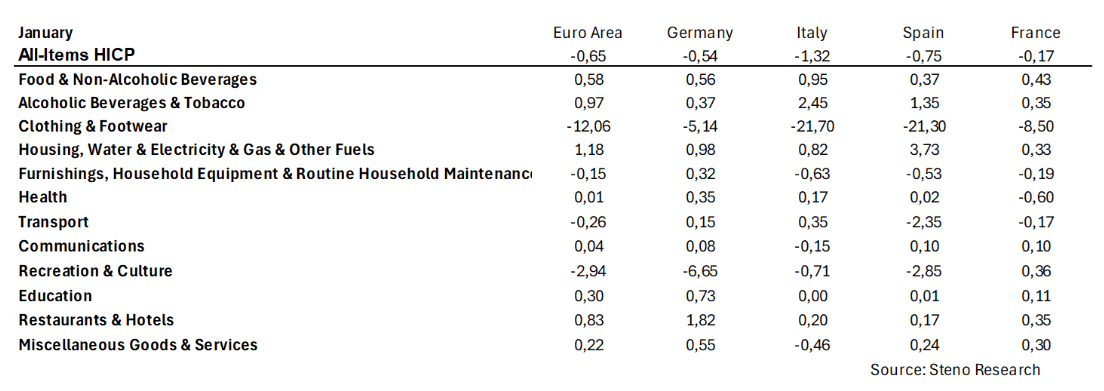

On top of that, our price observations through January confirm that the discount season is back with a vengeance in clothing and footwear, recreation and culture and to a certain extent also in food- and furnishings.

Our now-cast suggests that EUR-flation will print at -0.7% (in rounded figures) for January, which is well on the dovish side of what we have been used to in recent pandemic years and well below. Our March 2024 HICP YoY projection currently stands at 1.82%, which is close to 40 bps below market pricing and almost 100bps off the ECB projection.

Chart 1.a: January HICP details based on data up until today

Chart 1.b – Our HICP forecast relative to market pricing and ECB staff projections

The ECB is unlikely to rock the boat on Thursday but we still find strong risk/reward in betting on substantial forecast errors by the staff in Frankfurt in the coming months. Here is why!

0 Comments