EUR-flation watch: Why the ECB is off by miles in the Q1 forecast

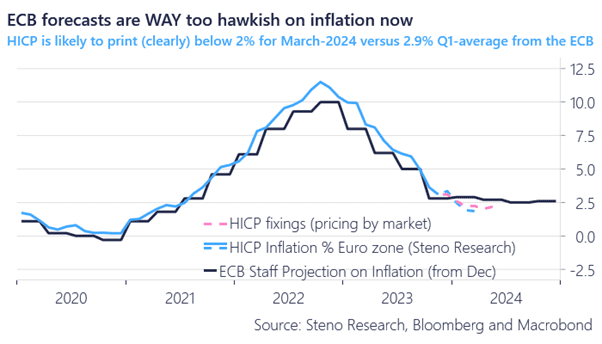

Welcome to this extremely table- and chart-heavy EUR-flation update. Based on extensive public demand, we have updated our inflation models for all of the big four in the Euro zone and we reach the conclusion that the ECB is off by >1%-point and potentially more by March-2024.

After having updated our models, we see March HICP printing at 1.84% versus ECB at 2.9% (Q1-average) and a market pricing of 2.25% (or thereabout), which basically leaves inflation below target before the end of the quarter. If we exclude the drift in our forecast assumptions (based on seasonally adjusted price observations through January), we end up very close to the market traded HICP fixings curve. The market is on top of the VAT-changes upcoming, while the ECB vastly exaggerates them.

After having watched the UK CPI Services this morning, we mainly see large risks on the downside (for inflation) stemming from namely services in Europe in Q1 based on January/March reversal patterns.

In the below, we will go through each country in bullet-points for you to understand the changes to the VAT landscape and we generally find ECB concerns of VAT increases to be overstated except for Italy. We also go through how to trade this story.

Chart 1a: Our EUR-flation forecast versus ECB and market pricing

We have updated our HICP models for all of the four major Eurozone economies and find both the ECB and the HICP inflation fixing to be too hawkish. January looks particularly soft.

0 Comments