ECB Watch: 6 charts on how EUR QT impacts markets

As per usual, we love visualizations of how policy impacts markets and with the ECB gearing up for an increased pace of tightening of liquidity conditions, we thought that a tour of EUR assets and how they are impacted by EUR liquidity trends would make sense.

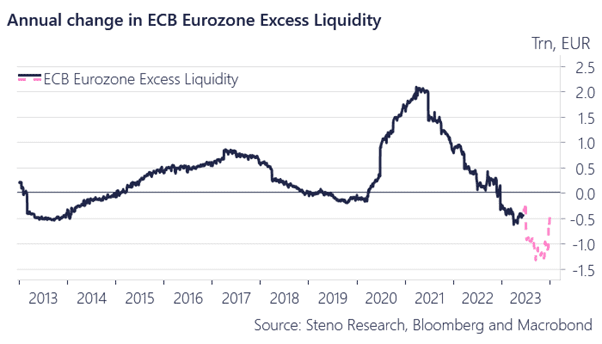

EUR liquidity is about to shrink fast from July and onwards. Around EUR 650-675bn will either mature or be repaid by the end of June. EUR 476bn will mature while the early repayment numbers will be released tomorrow. On top of that, the ECB will ramp up QT from July. EUR 15bn in PSPP and likely EUR 15bn in APP (but could be as much as 27.5bn on average in the APP).

This gives the following central scenario for EUR liquidity from now until New Year (yearly change in EUR liquidity in excess of required reserves)

Chart 1: EUR liquidity developments ahead

Ahead of the ECB decision, we release our chart book on the connection between EUR liquidity and moves in EUR markets. The ECB is likely to ramp up QT from July onwards and TLTRO repayments add to the liquidity malaise.

0 Comments