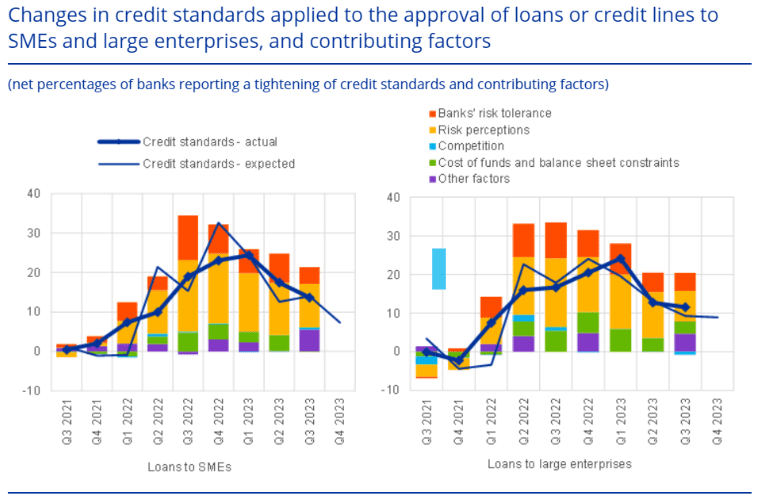

ECB Bank Loan Survey Nugget: Tight supply and even less demand

The net tightening of credit standards amongst Euro Area banks moderated slightly compared with the previous quarter, but the main impact of the tightening still stems from banks’ risk perception. Banks’ reportedly still see risks linked to a gloomy economic outlook (as do we), and they also remain attentive to company- and situation specific risk when providing or extending credit. All adding to the tightening lending standards.

Ultimately, the still tightening conditions help do the ECB’s inflation bidding but we see increasing probability of select areas within the EA succumbing to lack of credit availability.

Chart 1: Tighter credit standards applied to approval of loans

Today we had the Bank Loan Survey from the ECB, and the numbers say a great deal. Gloomy worries leave Euro Area banks hesitant about providing or extending credit, but, just as telling, demand is nowhere to be seen. Our main takeaways here.

0 Comments