Credit Watch: The worst is behind us in the SLOOS, but…

The quarterly SLOOS survey from the Fed was released a bit more than an hour ago and the results resemble the quarterly credit surveys from Japan and Europe released ahead of the US ditto.

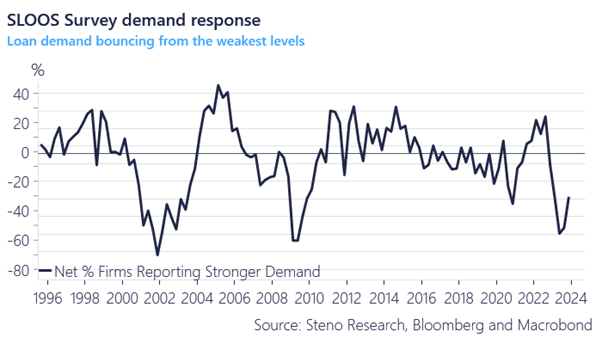

There is a sequential improvement in demand, while fewer banks tighten standards compared to Q3. So, is it good news or did the survey rather confirm the credit contraction? We lean towards the latter.

Let’s have a look at the highlights!

First, the demand side actually did improve from a marginal perspective. Fewer banks report weakening demand relative to Q4 and given how the survey is designed this ought to be seen as a positive compared to Q3, but levels are still abysmal when comparing them to current equity and credit valuations. See more below.

Chart 1: Demand for loans

The SLOOS is starting to improve sequentially, which bodes well for the hopes of a shallow 2024 recession.. but a wave of bankruptcies is likely still incoming, while it is hard to see credit and equity markets celebrating meanwhile

0 Comments