CHINA WEEK: What does new 2023 growth targets signal about Xi’s priorities

Welcome to our “China Week”. We kick off with this little political appetizer and will continue to post articles on the Great Dragon all week while the National People’s Congress holds its annual meeting.

Should you invest in China? How is the outlook for China real estate? How will the US engage China? Who is the next China? We have you covered over the next week! Sign up for a FREE 14 day trial to get all our China coverage.

First, let’s take a look at the political situation in Beijing with a special view on the new growth targets and strategic directions laid out over the weekend.

Keqiang: Why don’t we talk a little bit more about me

The government work report was published yesterday, but the accompanying speech by premier Keqiang was more so a personal tribute to his own decade long reign as China’s second-in-command. The work report itself reflected this underlying agenda with 25 pages dedicated to reviewing the achievements and problems in the past five years and only six pages on plans for the year ahead. In comparison, 76 % of the nearly 18,000-word report was dedicated to forward-looking policy aims last year. It is worth considering whether the primary purpose of this year’s work report is more symbolic than it is a stringent political roadmap (more so than it has been in previous years). This assumption extends to the Congress itself, with this year’s edition being the shortest in more than four decades. If one believes this thesis, there is significant room for down- and especially upside risk vis-à-vis report targets depending on who will take over the steering wheel of Chinese fiscal policy. Keep reading for our top picks for the leading posts.

With this in mind, we now take a look at the very moderate economic targets stipulated in the Chinese government work report.

- China aims to boost GDP by “around 5 %” this year. This is the lowest target in decades and indicates that party leadership is less concerned with encouraging investor enthusiasm than they are avoiding losing face with two consecutive years of missing growth targets. That being said, we expect that China could easily surpass a 5% GDP increase.

- The target for CPI is 3 % (unchanged from 2022) and 5.5% unemployment. In particular, the government plans to create 12 million urban jobs to target high youth unemployment. This is more than the 11 million job target of last year. Yet, the initiative is considered a rather timid response to youth unemployment considering 11 million Chinese graduates are expected to enter the job market this year.

- The buzz-work of this year’s report was ✨stability✨. Premier Keqiang underlined, several times, the volatile macroeconomic environment that China has been in for the past few years – including inflation and un-named forces attempting to isolate China economically (wonder who that is). Taking the Premier on his word, organic and stable growth is therefore preferable to a lightening-speed economic rebound fueled by massive stimulus packages. Instead China will incentivise domestic consumption by boosting people’s income levels without further specifying how this will be achieved.

- China aims for a conservative budget deficit at 3% of GDP vs 2.8% in 2022. The cautious approach is seen, perhaps, most clearly in the spending allowance of local governments, which is set to increase by 3.6% compared to the whopping 18% increase last year. Financing for transportation, too, has been put on the back burner.

- On Sunday, the governor of China’s central bank stated that “China will continue to adopt a prudent monetary policy”. Still, he emphasized that M2 money supply and aggregate financing should be in keeping with nominal GDP growth, as monetary policy will stress counter-cyclical adjustment.

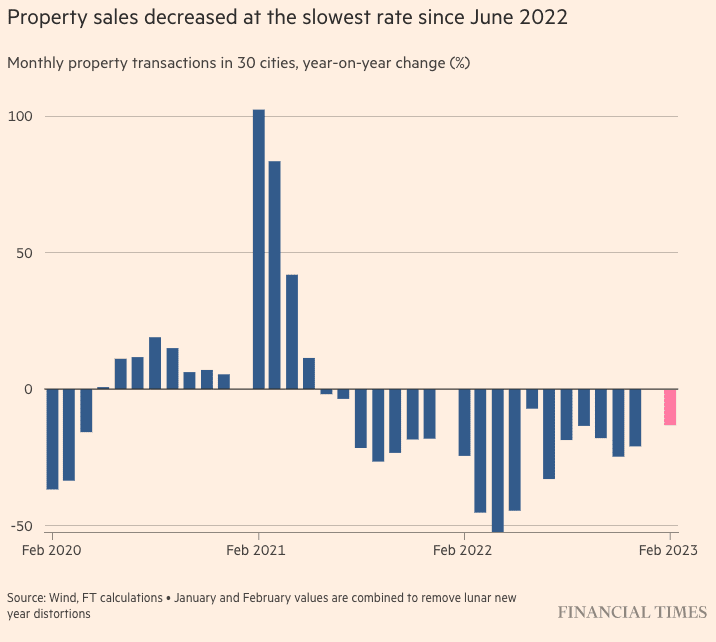

- Bullish China observers have been waiting in anticipation for further easing of the crackdown on China’s suffering real-estate developers. Mr. Keqiang sent mixed messages: the Chinese government would ✨stabilize ✨ spending on big ticket items including housing will continue to curb “unregulated expansion” in the property market. Core Chinese Housing stocks fell in response to the underwhelming news.It would appear that the government is continuing down their current path of improving the housing sector on the margins – a gradual shift which started in November when the government introduced 16 supportive measures for developers that included a $256bn credit line to select developers and relending programmes for unfinished homes.

Source: Financial Times

Geopolitical Gobsmacks (and some footnotes)

Military preparedness: Premier Li Keqiang said that the People’s Liberation Army should intensify “military training and preparedness across the board”. The country’s military budget will increase by 7.2 % in 2023 – the third consecutive year that the growth target of China’s defense budget increases. The spending pledge is still well below the symbolically significant double-digit defense increase which was last seen in 2015, when the Chinese military went through a comprehensive overhaul. The Chinese defense budget has doubled since 10 years ago, and does not take into account various expenditures such as weapons imports and money spent on the PLA’s strategic forces. Therefore, real military expenditures may be as much as 40 – 55 percent higher. Will be interesting to see how much of this ends up on the battlefield in Ukraine!

Taiwan was granted little more than a footnote in the work report. 134 words were spared in the master document which largely served to reiterate the ‘One China policy’ towards Taiwan. Li Keqiang boasted that Beijing had resolutely “fought against separatism and countered interference”. No noticeable escalation in the rhetoric. Similarly, he said the principle of “patriots administering Hong Kong” had been firmly enforced.

Zero-Covid Policy: Li Keqiang said that during his tenure as Premier, China had secured a victory over the coronavirus, giving further encouragement to anyone believing that a China re-opening is here to stay.

U.S rivalry: Several commentators have noted that the anticipated replacements in China’s financial leadership (read more below) signals an inward shift in China’s economic priorities. Several passages in the work report play into this narrative with the emphasis on boosting domestic consumption and China’s promotion of technological independence. Special funding to support chip development and other key industrial sectors will increase by nearly 50 per cent to 13.3 billion yuan (US$1.9 billion) this year from 2022 in a move to counter the U.S ‘Chips and Science Act’. While anti-trade sentiment towards the U.S is apparent, it is less clear that Xi and his compatriots are heading toward a secession from the entire world economy. According to Keqiang, China is taking active steps to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. A free trade agreement with 11 countries in the pacific region excluding the U.S. China is set to release its import and export data for the first two months of this year TOMORROW, which will provide a glimpse into demand for global trade.

Xi’s Ladies-in-Waiting

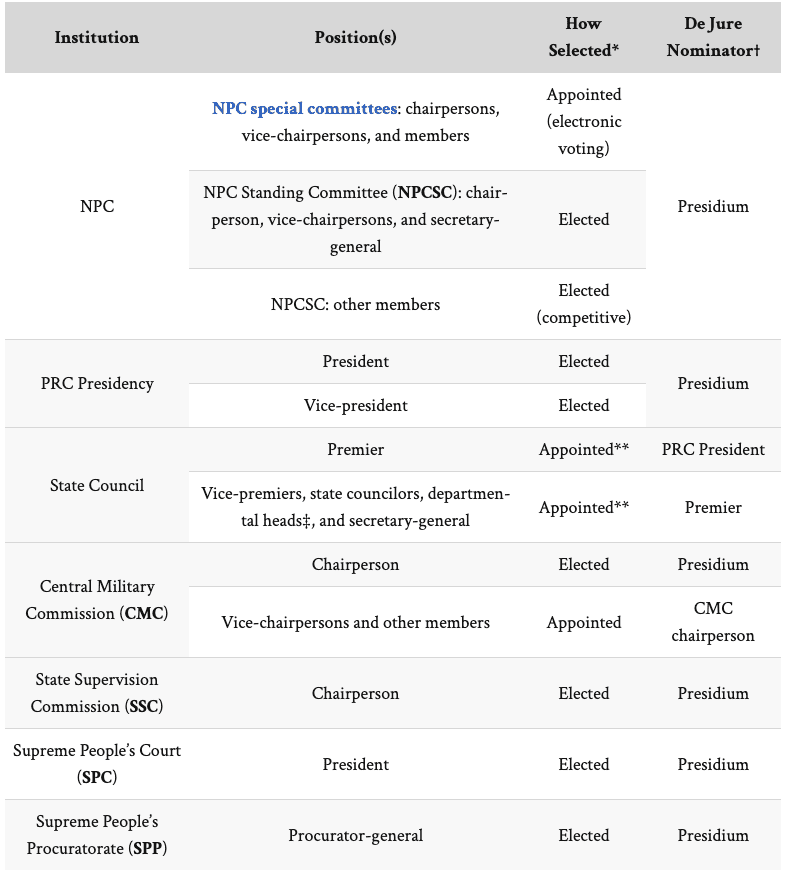

Summing up the government report, one could say that Xi and his lame-duck Premier are trying to manage expectations. The meager assortment of forward looking policy proposals in the report and the corresponding conservative targets have added another level of interest in who will steer China’s economy for the next five years. Through a mixture of ‘symbolic’ voting procedures and outright appointments, several new top officials in China’s financial government agencies will be selected in the next couple of days.

Here are the most likely candidates:

- Li Qiang is expected to take over as Premier from Li Keqian after Xi Jinping named him party No 2 in October. Quang is a former party boss of Shanghai who presided over the metropoles two-month Covid shutdown. Some experts believe his tenure in Shanghai points to a pro-business mentality based on his efforts to attract foreign investment to the Jiangsu Province. . In China, the premier is traditionally responsible for managing the economy, with several vice premiers supporting his work in specific areas.

- Ding Xuexiang, Xi’s current chief of staff, may become the next executive vice premier based on the new ranking in the Politburo Standing Committee. If this holds true, Xuexiang will be responsible for China’s domestic economy, particularly the country’s fiscal policy.

- He Lifeng, who leads China’s powerful National Development and Reform Commission, may be appointed as the next vice premier in charge of economic, financial and industrial affairs, Nomura analysts said. In 2016, He Lifeng was appointed as the Chairman of the NDRC, succeeding Xu Shaoshi. In this role, he oversees China’s macroeconomic policies, as well as its economic planning and regulation. He has also played a key role in China’s Belt and Road Initiative.

- Zhu Hexin, chairman of China’s state-owned financial conglomerate Citic Group, is the leading candidate to succeed US-educated economist Yi Gang as central bank governor, according to the Wall Street Journal.

- Meanwhile, the jury is still out on who will replace Han Zheng to oversee Hong Kong and Macau affairs. While the west was supporting Hong Kong by holding two fingers over their eye, Beijing actually managed to suppress the Hong Kong revolts rather successfully. Hong Kong remains the “best-case” model for Taiwan, but it’s an entirely different story of course.

In the table below you can see the list of top posts which are up for grabs this week. While we expect appointments to further cement the power position of Xi’s cadre, but there are still important nuances and signs to look out for:

Source: NPC Observer

STAY TUNED FOR MORE

Very interesting stuff, but we’re not done here! Over the coming days we will continue our China coverage with several insights and editorials. Look forward to an update on the Chinese re-opening, a look at US restraints on Chinese investments and especially Andreas Steno’s take on China in his upcoming editorial. Sign up for a 14 day FREE trial to receive all this content directly to your inbox.

0 Comments