Central Bank Watch: The Fed has gone from QE to QT to QB

The extreme volatility in the USD curve continues and Jay Powell gave a green light to further curve steepening by hinting that term premias could drive up the curve allowing the Fed to tighten a little less in the front.

In this piece, we are going to take a deep dive into central balance sheet structures in the US and in Europe, which reveals that the ECB is much more determined in its attempts to bring liquidity down relative to the Fed. This is another reason to expect EUR-flation to drop faster than USD-flation.

Conclusions up front:

– The Fed has gone from…

From QE to QT to QB

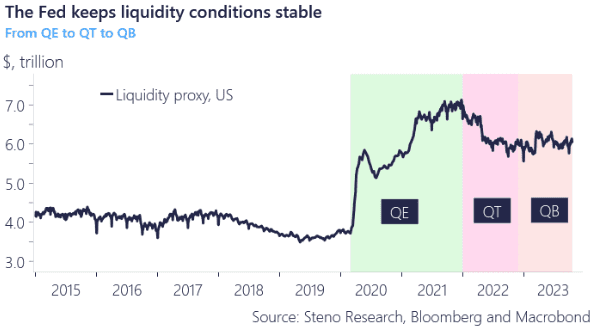

The Fed has gone from easing the liquidity situation to tightening the liquidity outlook to now balancing the liquidity outlook.

When the Fed allows the bond portfolio to shrink (by up to 95$ bn a month) the ON RRP is a release valve swallowing around 70-80% of the liquidity effect as reserve USDs parked at the facility are tempted back out to fill the gap left from the Fed as yield incentives improve.

Since late 2022, liquidity developments in USDs have flatlined due to this ON RRP sugarcoat, leaving a more benign outlook for risk assets than otherwise feared.

If the Fed disincentivized this process, we would be in for a completely different scenario in USD markets, likely also with material issues of filling the issuance gap.

Chart 1: From QE to QT to QB

The Fed no longer does QT in practice as they likely fear the repercussions for the yield curve should they allow USD liquidity to truly dwindle. The ECB on the other hand remains steady in bringing liquidity down. EUR-flation will drop faster than USD-flation.

0 Comments