Central Bank Review: Powell, a genius or a madman? 2024 looks like a year of fat tails

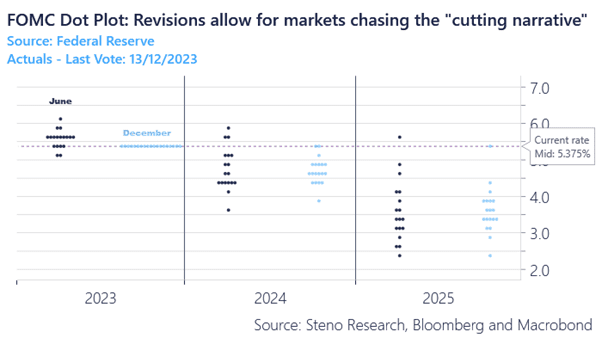

Oh, boy.. Oh, boy! USD markets felt almost EM like for a couple of hours after Jay Powel and the committee allowed markets to chase the cutting narrative by communicating three expected cuts in the dot plot for 2024.

I am not always convinced that the dot plot is a wise guidance tool as policy makers likely judge that a dot signaling three cuts relative to market pricing (ahead of the meeting) hinting of more than four cuts net/net should lead to a hawkish surprise. The opposite of course happened since narrative chasers in markets rather look at the sequential move than the nominal forecast.

Nonetheless, it is now clear that the FOMC is trying to orchestrate a soft landing with benign real -and nominal rates in the guidance paired with dovish communication in the press release. Is Powell a madman -or a genius trying to launch a rate cutting campaign while core inflation remains at 4%?

We will spend this analysis on the potential path ahead now that the Fed has allowed markets to ease financial conditions right, left and center.

Chart 1: Dot Plot revised markedly (chart showing June versus December)

Powell and the Fed aim for the soft landing despite all the Volcker-nonsense of 2022/2023. Will inflation ever drop to 2% if the animal spirits are unleashed again? Tails look fat for 2024.

0 Comments