5 Things We Watch: Labor Market, USD, Oil, Equities, And An Impending Credit Crunch

Welcome to this week’s edition of the weekly recurring ‘5 Things We Watch’. No rest for the wicked, and the editorial office has thus been plowing on full steam ahead. In this edition, we’ll widen the focus and get around to assessing thematics from different corners of the economy. As always we’ll be concise, and the below listed are merely key observations of which our premium clients can find the full reports – so consider signing up and joining the fastly growing Steno Community. Our offer of a 14 day free trial is still running.

This week, we’ll zoom in on the following 5 key topics captivating macro:

- The US labor market (Labor Market Watch)

- Possible USD strength? (Dollar’O’meter)

- A (fleeing) bull case for oil (The energy cable)

- Equity pricing (Asset Allocation Watch)

- The impending credit crunch (Steno Signal #44)

Without further ado, let’s get to the matters at hand.

1) The US labor market

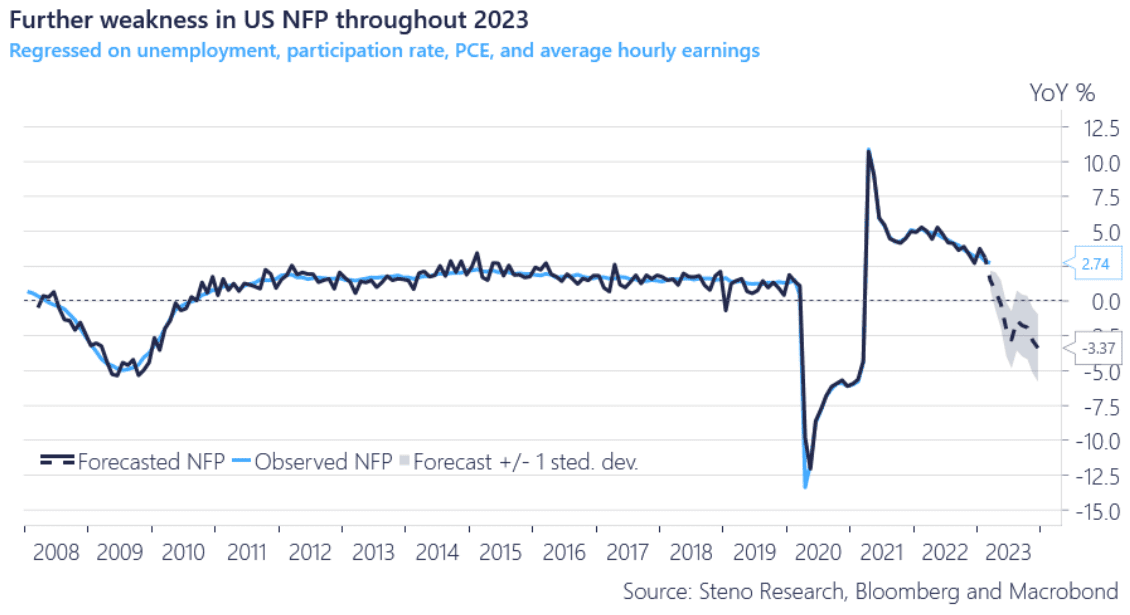

Regressed on multiple labor-market-sensitive factors, the below model indicates quite a significant cooling of the otherwise record-strong labor market. Talking inflation, a softening labor market may just be THE most offsetting parameter to bring such down, and these early showings and the projected trajectory do arguably indicate an economy headed for sounder and thus sustainable levels.

It should though be a CLEAR indication for the Federal Open Market Committee (FOMC), that policy is restrictive to a point that is not durable, and that it may be time to adjust course. Some of the most lagging parts of the economy – (commercial)real estate and the labor market – are both showing initial signs of distress.

In US equities and from regressed sensitivity, defensives such as Consumer Staples and Utilities perform somewhat better when the labor market weakens. Discretionary income is suppressed and so is demand for discretionary goods. High-beta, high-duration assets trading on high multiples are discounted in such a recessionary environment.

Data suggest that such a defensive rotation may soon be reasonable, though the timing is tricky as always. We keep monitoring the situation diligently and allocate accordingly. We’ll make sure you’re the first to know, once we rebalance our portfolio. We encourage you to read the full labor market report here.

Chart 1: Weakening to continue throughout the year

Though this last week has furnished fewer fires, global macro currents never truly rest. With banking stress and troubled commercial real estate idling, we eye a window for us to turn our attention elsewhere.

0 Comments