USD’o’meter – Six reasons why the USD doom and gloom is overdone

We assess the USD outlook in a structured way in our regular USD’o’meter based on the following six parameters. In this piece, we will elaborate on each of the model parameters and ultimately sum it up in a logistic regression.

- Technicals

- ISM – IFO spreads (relative growth)

- Positioning (% of open interest)

- Relative rate hike expectations EUR – USD

- Relative energy prices / Relative banking stress

- Relative exposure to China

Overall, we find it interesting that the USD has not weakened MORE given the pamphlet of headwinds it has had to deal with in recent months – and statistically the tide is about to turn for the USD in our model framework. Position accordingly?

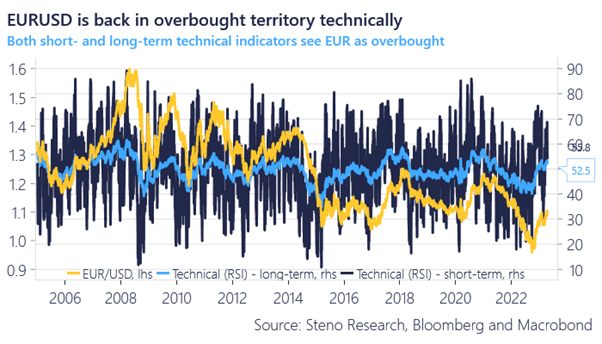

Factor 1 Technicals: EUR is overbought

We find increasing technical backing for a short EURUSD position as both short- and long-term oscillators (such as RSIs) hint that the EUR is getting crowded, while current EURUSD price dynamics look reminiscent of the head and shoulders pattern unfolding in late 2020 to early 2021.

Our statistical/logistic model on Technicals is in USD buy territory now.

Find out about the rest of the model parameters and the logistic regression model with a FREE 14-day trial to our service.

Chart 1: EUR looks overbought on short- and long-term oscillators

We have updated our USD’o’meter amidst widespread doom and gloom around the USD outlook. But is the outlook really that bad? Our logistic regression is not convinced that the death of the USD is around the corner.

0 Comments