Steno Signals #44 – Are you sure that you prefer another currency to the USD?

Happy Sunday and welcome to our flagship editorial.

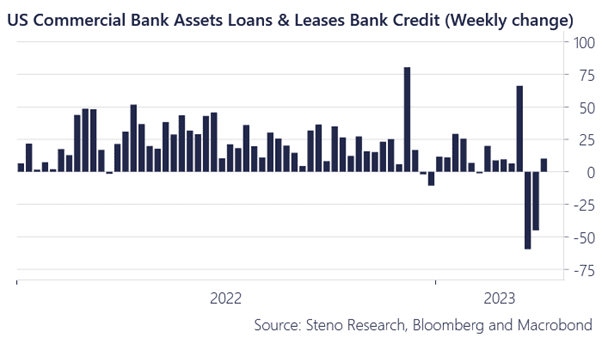

A credit crisis doesn’t unfold overnight and this week’s data once again allows the macro narrative to remain calm before the storm. Two weeks of credit contraction in March-2023 (partially due to transfers of SVB/Signature loan books to the FDIC) was replaced by a modest rebound, which was again impacted by technicalities due to the resurfacing of the SVN loan book at the balance sheet of First Citizens.

In any case. A credit crisis doesn’t happen overnight and the credit trend remains (very) worrying, but the market can breathe a sigh of relief that this really short-term economic meltdown is canceled.

We provide you with the road map to a credit crunch in this weeks editorial! Join us for a FREE 2 week trial to read it!

Chart 1: Down down and up

The de-dollarization chatter is back after the IMF COFER data showed a new drop in the relative size of USD FX reserves in Q4-2022. Currently, everyone agrees that the USD will weaken from here, which is when you need to become worried.

0 Comments