Steno Signals #93 – Material stealth QT upcoming during a war economy

Happy Easter and welcome to our flagship editorial!

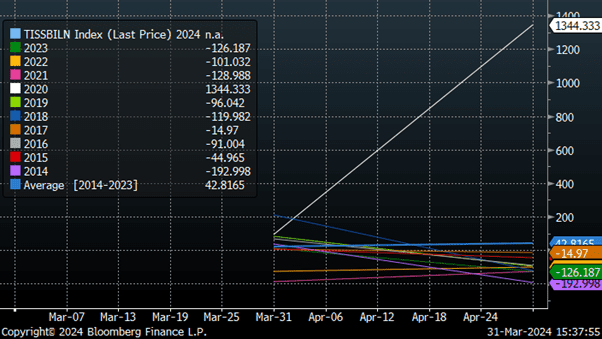

The tide is turning on USD liquidity and the four most recent bills auctions have seen net negative issuance, which is a harbinger for the trend into April, which is typically strongly net issuance negative due to tax seasonality (see chart 1). Only during the first lockdown in 2020, did the net amount of outstanding bills increase through this period, which makes for a solid hit ratio in predicting (much) weaker USD liquidity in Q2 this year.

We wrote on New Years eve of 2023 that “USD liquidity is likely going to increase massively in Q1 due to a series of technicalities surrounding the BTFP, ON RRP and TGA facilities, which makes us set for a material rally (or a blow off top) in Q1.”, which I guess was as precise as it could be.

Ahead of Q2, the tide is (temporarily) turning and Q2 will likely deliver a net liquidity subtraction from USD markets, which could be a hint to materially alter the risk profile of the portfolio for the coming months. The ON RRP and the Fed QT decision will likely be impacted by the US Treasury issuance profile with material repercussions for liquidity.

Chart 1: Mar-Apr net bills issuance between 2014-2023

The US is effectively running a war economy and the ultimate headache is typically not seen until the production pace is slowed. Meanwhile, Yellen allows for stealth QT in upcoming weeks and months.

0 Comments