Steno Signals #79 – A Christmas present full of USD Liquidity from Powell and Yellen!

Happy Sunday and welcome to a short and sweet version of our flagship editorial!

We want to take the opportunity to thank you all for your support throughout the year and wish you a peaceful holiday season and a happy new year! We will be back at full speed on Dec 27, but will release bits and pieces over the coming couple of days as well!

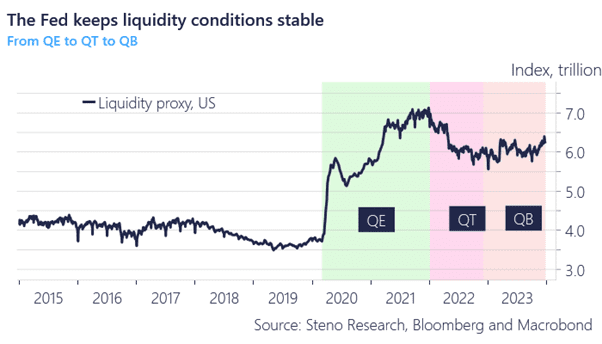

The holiday season is typically one of tight USD liquidity but not this year as the liquidity wizardry from the US Treasury and the Fed keeps liquidity (increasingly) ample!

Liquidity conditions have improved markedly over the past couple of months, and we are about to enter a QE-like liquidity environment unless trends reverse soon, which they are unlikely to.

Liquidity has been improving at a $200bn a month pace since early November due to a pamphlet of tricks from BOTH the Fed and the US Treasury, and through the past weeks another sneaky “liquidity adding” factor has popped up! This is of major relevance to the overall risk sentiment.

Chart 1: The Fed is soon back in QE mode?

Risk assets are unlikely to sell off until the liquidity tricks come to a halt. Another trick up the Fed’s sleeve is now adding to USD liquidity ahead of New Years. A nice present from Powell and Yellen to banks!

0 Comments