Steno Signals #74 – Did King USD just break?

Happy Sunday and welcome to our weekly flagship editorial!

The sharp move in USDJPY and other USD pairs towards the end of last week has caught our attention and it arrives on the back of Powell letting go of the steering wheel on USD real rates.

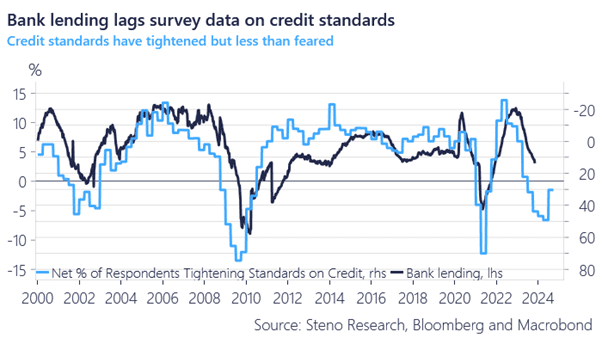

The weekly credit data from the US economy keeps weakening and we are en route for a credit contraction in the US during Q1/Q2 next year. Powell is probably right to let go of the tightness in USD real rates, but the question is whether he could be tempted to take back control in December in a final policy error?

As per usual, we will take a tour around global macro across all asset classes.

Conclusions up front:

1) Stick to strong carry cases in FX

2) Fixed income trends will work towards re-steepening soon

3) No catalyst for a major sell-off before Q1 in equities

4) Oil bears are as loud as ever. Time to buy tactically?

Chart of the week: We are still on track for a credit contraction in the US

Sudden sharp moves against the USD after Powell let go of the monetary steering wheel. Will the Fed take back control or has the USD already peaked? This is the key question in global macro before New Years.

0 Comments