Steno Signals #72 – When a recession meets a melt-up in equities and bonds

Happy Sunday and welcome to our flagship editorial!

What a week. The BoJ no longer has a firm guidance towards higher 10yr bond yields, the Fed accepted higher long bond yields as an excuse to pause and economic data has been abysmal. That cocktail has so far allowed the everything rally to thrive in a way we haven’t seen in quarters, but the feedback loop introduced by the big central banks may limit the scope of the bear market rally.

Let’s have a look at why, and as per usual we will show the 2-3 most important charts for each major asset class along the way!

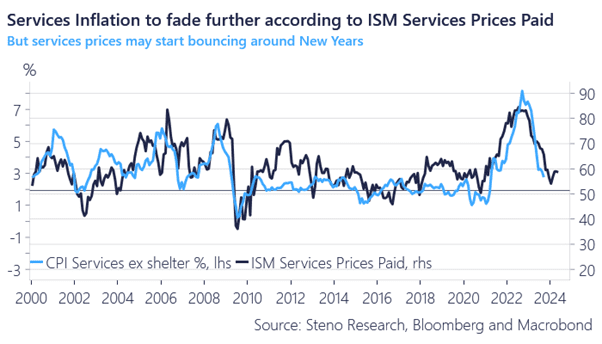

The chart of the week is taken from the monthly ISM Services survey, which delivered an odd, almost stagflationary, cocktail. Prices paid seem to have bottomed (short-term), leaving sub 3% readings in US inflation unlikely for another couple of quarters. How does that rhyme with the Fed allowing the “everything rally” to run its course?

Chart of the week: Inflation not going to return to 2% according to the ISM Services price survey

The Fed introduced a new feedback loop, which is likely to limit the scope of this bear market rally. Remember that Q4 data usually looks really bad in an inflationary environment, while Q1 is the quarter of “inflation math”.

0 Comments