Steno Signals #49 – Everything related to the deposit crisis keeps worsening beneath the hood

Happy Sunday and welcome to our flagship editorial.

The higher for longer narrative is back alongside increasing confidence in a prolonged period of positive economic activity growth. Fair enough. This is in our view the correct short-term assessment of the economic damage from the banking crisis.

The bank walk (Kudos to Jim Bianco for that wording) will allow the economic policy makers, markets, and politicians to sleepwalk into the recession as the underlying fundamental case for a marked credit contraction continues to grow, while the imminent crisis mode fails to appear.

So, let’s lean back and remain long risk for now? Might be the right bet through May, but we see several imminent triggers for renewed risk aversion in markets by early June.

The case for higher for longer is debatable… and the USD is on the move (against the CNY)

The higher for longer narrative gained some traction through the week based on three economic readings and a few hawkish FOMC remarks.

First, the Canadian CPI report made for unpleasant reading for pause-proponents. The 0.7% MoM increase was heavily impacted by retail energy prices, and we already know that the data is out of date and the Median CPI surprised to the downside. Easy now folks… a pause from BoC has no chance of impacting retail energy prices.

Second, the initial claims surprised markedly on the low side after Massachusetts allegedly saw a decline of 14k claims (LOL!!) after an increase of 6k claims (due to fraud) in the week prior. Without this obvious mess in the data quality from Massachusetts, the upwards trend would have remained intact.

Third, the Philly Fed report showed early signs of rebounding manufacturing activity. The big issue is that the Philly Fed details lead ISM headline by 6-9 months. Sure, the rebound could be seen in the report details as well – but it will only matter in 2024.

All in all, we find the repricing of front rates interesting to fade, but also admit that no news = bond bearish news for now.

Find out why that will INCREASE the issues in banks below with a 14-day FREE trial.

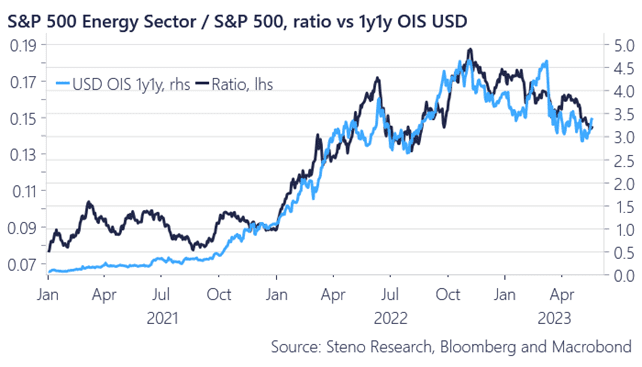

Chart 1: Energy to SPX ratio vs 1y1y USD rates

Given the lack of an imminent economic crash risk, bond bears have been back in the driver’s seat. No news is bond bearish news, which in turn is likely to exacerbate the already worsening root cause of the deposit crisis. We are on high alert for the ramifications of the price action in the USD.

0 Comments