Steno Signals #47 – The correct calculations on how severe this banking crisis is..

Hi all,

Happy Sunday and welcome to our flagship editorial Stenos Signals! Remember that we host our inaugural monthly Q&A session for premium clients on Wednesday. Find the link here.

Our doctrine remains the same. If you cannot show it in a chart, then it’s not true! Loads of charts to be expected and less words.

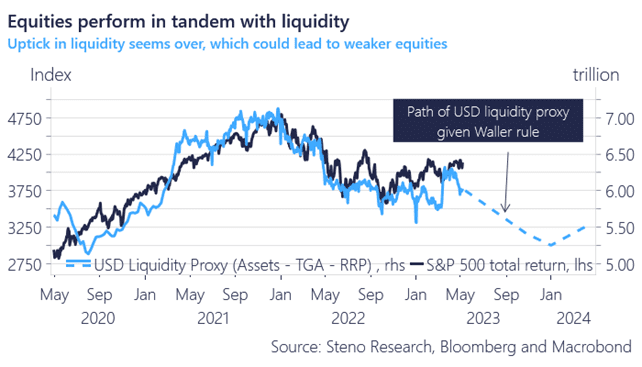

We are now through (most of) the week without banks under FDIC receivership, but several regionals remain extremely vulnerable at this juncture. We are at the phase where USD liquidity dwindles because of the actions taken by the FDIC.

Let’s take the First Republic Bank case as an example.

The FDIC will pay back the loans outstanding on behalf of First Republic Bank

By the date of FDIC Receivership, First Republic Bank had an outstanding of roughly $93bn and as part of the deal details with JP Morgan, we know the following:

First Republic Bank had $93bn outstanding in emergency lending measures

JP Morgan pays the FDIC $10.6bn in cash this week

JP Morgan pays the FDIC $50bn in cash in 5 years

First Republic had $15bn in cash and $4-5bn in cash-like assets

The $93bn owed to the Fed will hence be covered via the ($10.6bn+$50bn+$15bn+$4-5bn), which leaves FDIC with $13bn to cover today. The $13bn+$10.6bn will likely be paid back this week, while the FDIC is likely to take up a loan at the Fed to cover the 5-year $50bn loan to JP Morgan. Net/net liquidity will dwindle by almost $25bn this week due to First Republic Bank being taken into FDIC receivership.

Find out ALL the details of the banking crisis and how severe it is with a 14-day FREE trial below.

Chart 1: Dwindling USD liquidity is now the name of the game

How do we approach the most anticipated recession in newer history when the labor market keeps holding up? And how severe is the banking crisis in a historical context? We aim at providing you with the answers here.

0 Comments