Steno Signals #38: Is this good or bad inflation?

“I have worked out that I am virtually Chinese, because everything I own is from China.”

Sean Lock (RIP)

Welcome to another edition of our flagship editorial Steno Signals in these schizophrenic macroeconomic times. Steno Signals is out every Sunday afternoon CET all year round.

The Chinese reopening play is one of the best cases of schizophrenic market assessments of economic developments so far in 2023. Conviction seems extremely low among our speaking partners and who can blame them.

A quick summary of the discussion on China in 2023:

January: China is OPEN. Buy everything with an arm and a leg.

February: Chinese data is NOT showing signs of the reopening feeding through

March: WOW, China has actually rebounded, and inflation and growth will rebound in the West

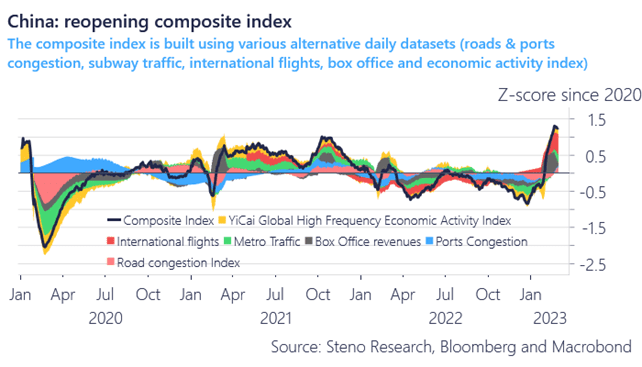

Chart 1: Assessing the Chinese reopening via live-data. The reopening is stronger than ever

Our bottom-line remains the same as it has been through the year. China is open, and if we assess the momentum via daily data, the momentum has not been better than right now since the outset of the pandemic. We hence comfortably lean long in trades with a China-beta still.

Find out what it means for our trading allocation and for inflation expectations below. Remember that the first 2 weeks are FREE.

There are undoubtedly signs of inflation pressures resurfacing in leading indicators, but remember that activity leads inflation. If inflation returns (from a momentum perspective), it is because activity has picked up markedly ahead of it. That is not bad news.

0 Comments