Steno Signals #37: Revisiting the macro regime indicators considering recent developments

Happy Sunday and welcome to the flagship editorial Steno Signals.

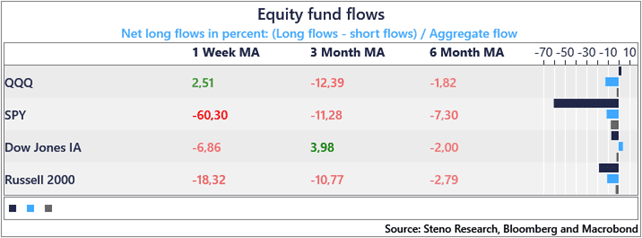

We intend on releasing a positioning watch series every Saturday, but the CFTC data is still not being released why we rely on ETF / Flow-of-funds data for the time being. Structural positioning is getting heavily underweight/short in equities again and we have seen the fiercest weekly flow-based selling of the S&P 500 in a long time.

We get all the bearish arguments, but it is still an overwhelming consensus story to take less risk than usual (for good reasons) – meaning that the outcome space for risk assets is not as skewed towards the left tail as it has been ahead of other recessionary periods.

Chart 1. Extreme selling of SPY last week

Revisiting the regime indicators considering Februarys developments

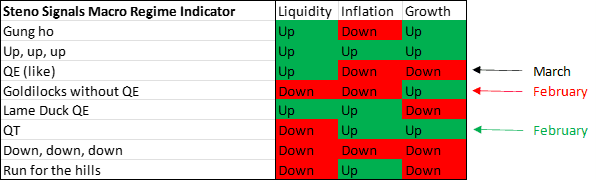

We approach month-end, which means that it is time to assess the developments through February relative to our forward-looking indicators and macro regime conclusions.

We released our monthly “Asset Allocation Watch” in the first week of February suggestion that liquidity and inflation would dwindle this month, while growth would bounce. Even if we had two out of three right, it can be overshadowed by having the third wrong and this returning inflation trend seemingly wrongfooted market participants and central banks to a large extent.

In hindsight, February hence ended up in the “QT-regime” rather than in the “Goldilocks without QE”, which was a gamechanger to asset markets and to our positioning.

Let’s have a look at the components and what to expect from the months ahead.

Chart 2. The Macro Regime Indicator for February and March

February did not play out fully as expected by our Macro regime indicator. We will assess why in the weekly editorial and update projections for March.

0 Comments