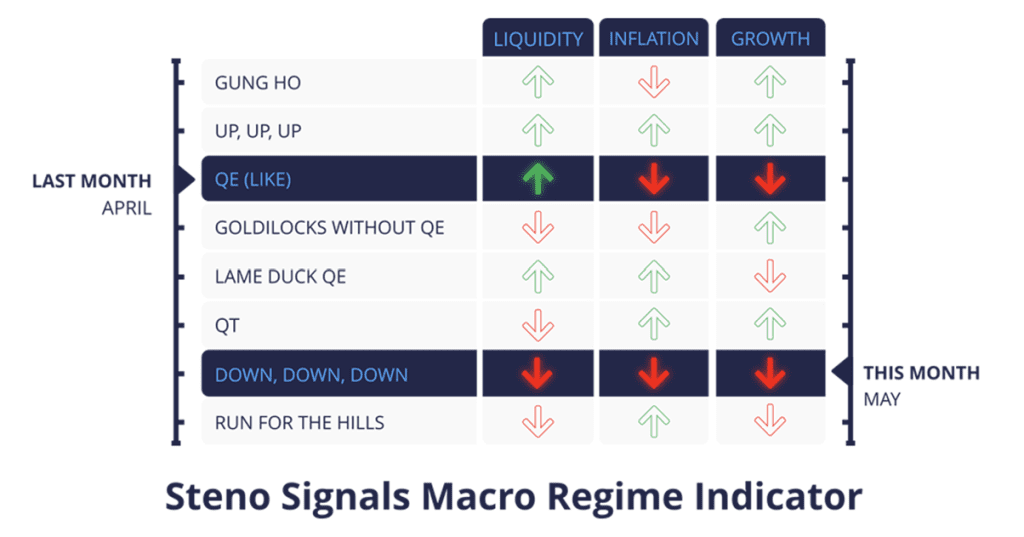

Macro Regime Indicator: The global liquidity outlook is worsening..

Hi everyone and welcome to our monthly update on the upcoming Macro Regime based on liquidity, inflation, and growth models for each of the large economies.

We plan on expanding the series to include a regular on each of EUR, CNY, JPY, USD, INR and GBP liquidity – including liquidity indicators in our datahub, but more on that once we are ready to reveal it all.

We have updated our models and found that liquidity, inflation and growth are likely to dwindle simultaneously in May/June. We move from a QE (light/like) environment to the down, down, down the macro regime, which will likely carry repercussions for your portfolio construction. You can now back-test each of the macro regimes and see the best-performing assets in every environment in our datahub (under the regime model).

Please have a look!

Chart 1: The Macro Regime will likely change for the worse in May/June

This month, we have decided to elaborate on the liquidity parameter since it is the one changing direction from April. We see a relatively sharp increase in the probability of tighter liquidity conditions ahead in May/June, but the timing is a tad tricky to grasp since it depends on political decisions in Congress (and potentially from central banks as well).

Try us out for free 14 days to gain access to our liquidity outlook in EUR, USD, JPY and CNY below.

We have updated our liquidity models and found a relatively firm shift from benign- to tighter liquidity conditions ahead in May and June. How will changing liquidity impact markets in USD, EUR, JPY and CNY? Let’s have a look at it.

0 Comments