Just as the markets were speculating about which spring month would see the first Fed rate cut of the cycle, a surprisingly high CPI report from the BLS swiftly dispelled any lingering dovish sentiment that had survived the recent NFP announcement.

We’ve analyzed both the CPI data (see here) and the current labor market in detail (see here), and although there are signs of cooling, it’s difficult to counter the recent adjustments in the OIS curve. This suggests that USD assets remain the focal point, and for the foreseeable future, EM macro strategies should lean towards spread/receiving rather than expecting an NVDA-like bull run in equities

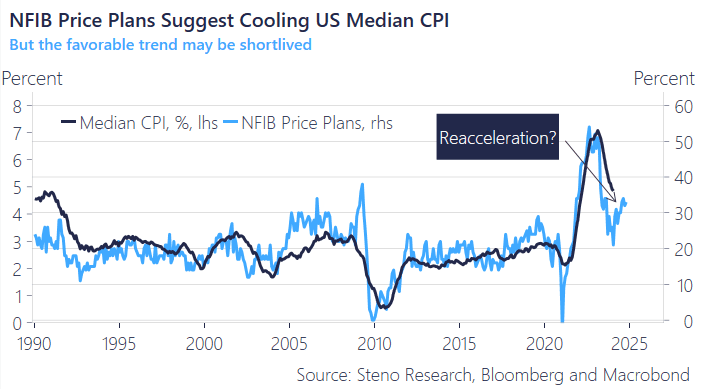

While we maintain a degree of optimism that the market consensus might eventually materialize, the current scenario—with NGDP hovering around 6% and the US 10-year yield just above 4%, and businesses hiking price plans- it is difficult to argue a shift away from US assets and the USD as the mainstays of financial markets.

0 Comments