Labour Watch: Why you should pay attention to the Border

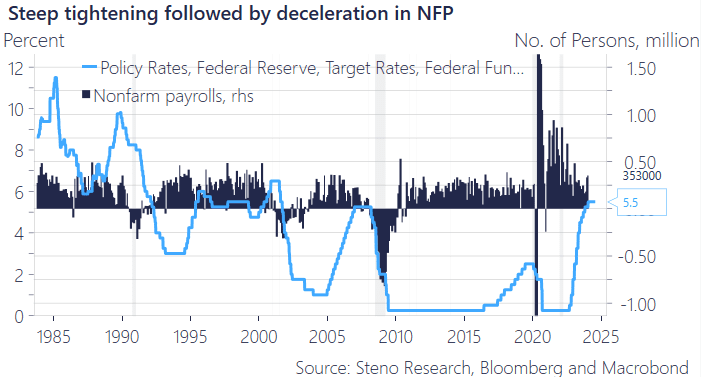

After last week’s (at least on the surface ) impressive jobs report—a focal point of our Sunday editorial ( see here)—we posited the possibility of an economic growth reacceleration, following the recent easing in the FCI.

The seasonal adjustments have clearly overstated the report’s impact, the non-seasonally adjusted figures reveal a loss of about -2.6 million jobs, aligning with the typical expectations for January i

As far as price action goes there is little denying that the Non-Farm Payroll was interpreted as a strong blowout print defying the few remaining bears who were awaiting a stinker. However, the BLS SA adjustment provides a rather distorted image of what is going on beneath the hood.

So what is going on in the US labour market?

In short: Everything everywhere all at once.

Over a longer trend, we’re observing a continued but orderly slowdown. However, the wage growth component, reflecting the “Prices Paid” aspect in the ISM services report, indicates intensifying price pressures. This suggests that Federal Reserve Chair Jerome Powell may need to undertake actions beyond mere appearances on “60 Minutes” in the upcoming weeks.

Still, the cooling is safely in the soft landing/no landing path, at least on the surface of it but cuts typically require blood

Chart 1: Non-Farm Payroll vs Fed Funds Rate

A lot has been said about the Non Farm Payroll report last week yet we believe certain aspects have still largely flown under the radar. Read which below

0 Comments