EM by EM #37: The Taiwan election & the Trade war

It appears that the cautious tone we struck in late 2023 is materializing in 2024: Bond yields are on the rise, and the significant escalation we have witnessed in the Red Sea recently aligns with what we earned could unfold a couple of months ago.

While we rarely miss an opportunity for a modest victory lap, it is undeniable that doing so amidst the current chaos feels rather bittersweet, particularly if these recent events are followed by heightened Iranian aggression, potentially pushing the existing tensions into a full-blown regional conflict.

We sincerely hope that the current tensions can be diffused through diplomatic means rather than military confrontations. It’s noteworthy that the risks we’ve been highlighting have gained prominence in financial markets over the past few days.

Unfortunately, we believe it’s worth turning our attention to another issue in Asia, albeit one that is currently less heated. Yet, the potential for a tail risk scenario leading to escalation seems to outweigh the ongoing challenges in the Middle East.

Taiwanese elections rarely garner significant global attention, but the one scheduled for just 10 days from now has captured the focused interest of both Washington and Beijing.

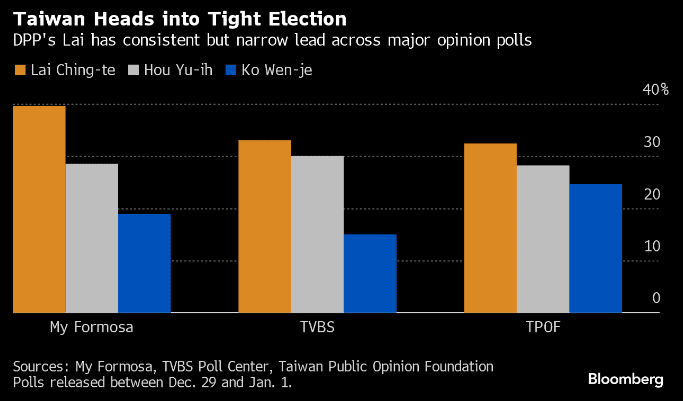

Recent polls favor the DPP candidate, Lai, who appears to hold an edge as we approach January 13th. For those unfamiliar, the DPP staunchly advocates for Taiwanese independence. If Lai secures reelection, the repercussions are likely to extend far beyond Taipei, with potential ramifications that could reshape the US-Sino relations and subsequently financial markets

Chart 1: Taiwan Poll, Bloomberg

The upcoming Taiwan election is just one chapter in the larger narrative of US-Sino relations, which is poised to return to the forefront of financial markets in the 2024 US election year. Will Taipei further contribute to the rising tension?

0 Comments