EM by EM #33: Early Hikers = Early Steepeners?

As markets have outpaced central banks and vanilla economists in pricing in future rate cuts while eagerly purchasing bonds (we recently secured another double-digit profit from this rally), the question that arises is how to effectively navigate this transition from a period of rapid buying to an anticipated rate cutting cycle in the emerging markets.

But before delving further into it, it’s essential to acknowledge the magnitude of the market shifts we’ve observed over the past month:

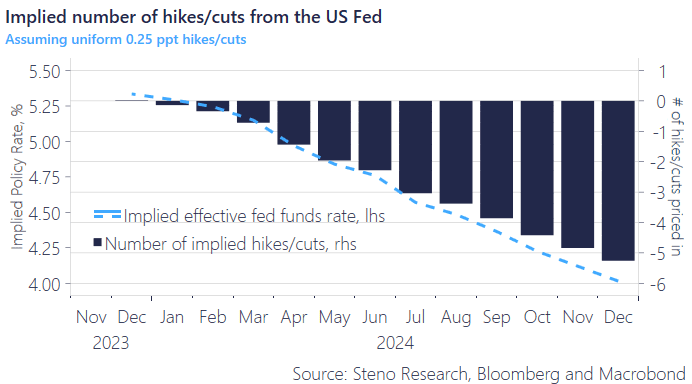

We’ve moved from pricing in around three rate cuts for 2024 by November 1st to now expecting a total of >5 rate cuts by January 2025. Following a subdued CPI report and some questionable bond auctions, the situation has evolved as follows:

Chart 1: Implied hikes/Cuts US

Forward curves continue to trend lower in the US and Eurozone. The early adopters are leading the way, but perhaps Yellen’s spending spree will pose another challenge for her EM colleagues. We have taken a look at potential receiver/steepener cases in EM space.

0 Comments