EM by EM #28 The Truth Hidden in Plain Sight

Leading up to yesterday’s Federal Reserve meeting, we observed the first tangible signs of weakness in the ISM release. In response, the markets reacted swiftly and celebrated following Powell’s somewhat ambiguous press conference, with pundits dissecting his words over the past 24 hours, drawing grand conclusions.

At Steno Research, we’ve been advocating for a U.S. restocking cycle since the summer. However, it’s worth noting that I’ve maintained a degree of skepticism regarding its potential durability, despite leading indicators and numerous data points suggesting a resilient economy.

While I never doubted that the ISM would eventually fall below par, recent PMIs in the emerging markets haven’t exactly exceeded expectations.

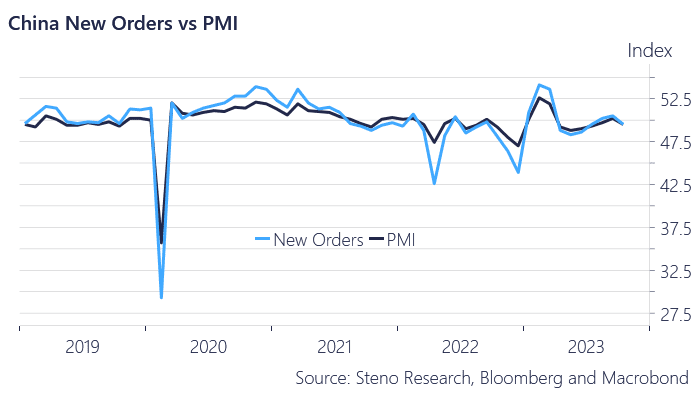

Most projections suggest that the stimulative effects of the recent Pumpgun (as discussed in my previous piece here) will reach their peak in 2024. Additionally, the PMIs in China not only disappointed expectations over the past month but also show few signs of imminent weakening.

New Orders following PMI composite:

Chart 1: New Orders vs PMI

Subscribe for the full article with a 14-day free trial, right here

The Chinese Stimulus will likely prove to be false flag and Yellen & Powell looks to have killed the USD streak. Read below for our thoughts on it and how we will likely play it

0 Comments