EM by EM #22 The Good, the bad and the ugly

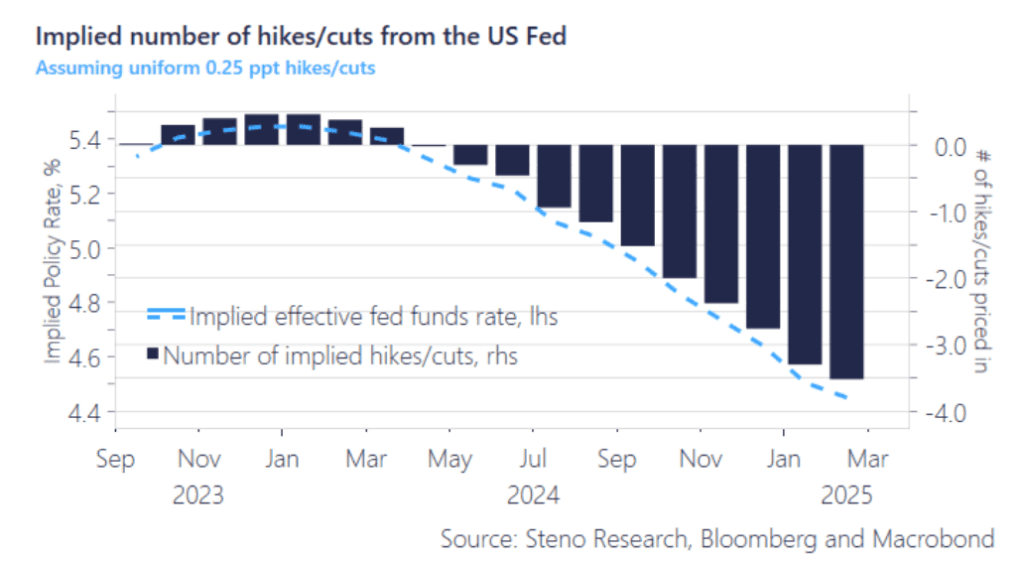

In light of the Federal Reserve’s decision to keep interest rates unchanged and the increasing agreement among members of the FOMC and the market on a “higher for longer” scenario, it’s clear that this expectation is primarily driven by the consistently robust performance of the American economy.

The FOMC foresees an extended period of elevated rates, and staff projections indicate no significant immediate concerns.

On the contrary, the 2024 projection suggests a very modest moderation, akin to what popular pundits are referring to as a “Soft Landing.”

Chart 1: Implied FFR

FED is pausing but EM’s are already fed up and the dynamics of the 2022-trade remains our frame of guidance. But what could turn the table?

0 Comments