Something for your Espresso: Will the Fed convince markets that this is not a pause?

“This is not a pause… This is not a pause…. This is not a pause…” Jay Powell

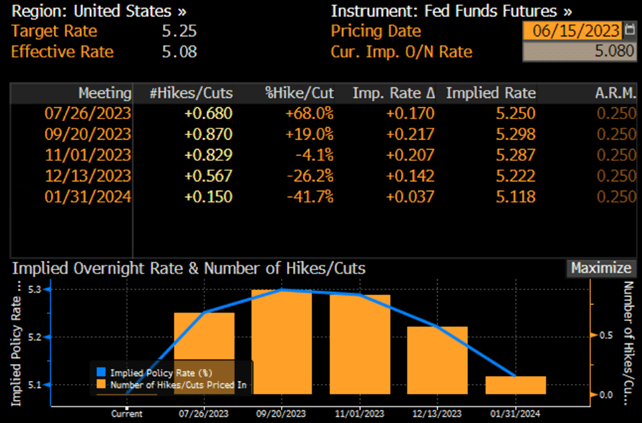

The Fed didn’t hike but kept the door wide open for further rate hikes in coming months. This is central banking 101. To convincingly pause, you need to keep an embedded hiking bias in your rhetoric to ensure that markets do not extrapolate the trend with rate cuts being priced in.

Powell kept reiterating that the speed of hikes is a separate discussion to the ultimate terminal rate level. The base case within the Fed is likely to hike at a 12.5 bps speed now (i.e. every other meeting).

We find the four points to be the major take-aways from the meeting:

1) This is a skip not a pause – the Fed NEEDS to say this. The perfect pause includes an embedded hawkish bias as markets would otherwise chase cuts in pricing

2) July is LIVE but the hike is not necessarily the base case for Powell. Powell was not overly firm on further hikes. He wants to buy himself time. Dovish compared to the press release.

3) The new inflation projections paired with an increase in the number of FOMC members seeing balance of risks tilted to the upside for inflation leaves us with a pretty decent risk/reward in betting on disfinflation relative to the central outlook from the Fed

4) Duration (and Duration intensive stocks) will continue to perform

Chart 1: Fed pricing post the FOMC meeting

The Fed is not on pause. That is at least the message they try to convey to markets, but data will decide, and we have no concrete guidance on the path ahead. A well-orchestrated pause has an embedded hiking bias.

0 Comments