Something for your Espresso: When UK inflation turns into the most important key figure on earth

I have three things on my mind this morning, on top of the Chinese GDP released overnight:

First, UK inflation is a harbinger for anticipated global service inflation pressures. Watch out on Wednesday when the June report is released as the last major inflation number from June.

Second, the weakness of the USD and why the EUR resilience is so profound despite a load of negative data surprises out of the Euro zone lately.

Third, why there are signs of a short-term cyclical comeback, which is not unusual ahead of the actual recession.

Here are my thoughts and how I currently find risk/reward in trading them. As warned, the thoughts are slightly longer than usual, so you might need a doppio instead of a single espresso to get through them today.

Enjoy the reading!

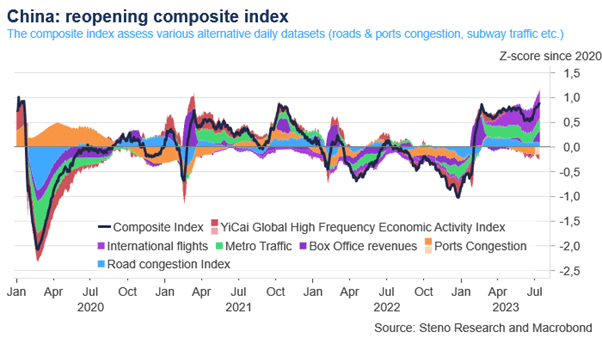

Before we get to these topics, we can still conclude that Xi Jinping’s China is growing above target for this year so far with 6.3% YoY growth, even if the 2Q number of 0.8% QoQ is a bit on the “heavy” side of the target. Our live indicator keeps hinting that the Chinese reopening is doing better than reported by many and relative decent numbers from the industry this morning may hint as much.

Chart 1: Our live indicator of the Chinese reopening keeps reaching new highs

We are on CPI alert from the UK this week as the price pressures in the UK are seen as a harbinger for global sticky service inflation developments. If the UK CPI finally starts mirroring the PPI, we may get a piece of positive disinflationary news for global markets?

0 Comments