Something for your Espresso: The slowdown in the US is “well-hiden”

Morning from Europe!

Bizarre move in USDJPY yesterday on the back of Ueda’s rhetorical opening of rate cuts in plural paired with an abysmal 30yr JGB auction.

If the BoJ indeed intends on moving the interest rate needle not only once but potentially twice during the next year, we’d argue that they swiftly run into trouble controlling the yield curve again.

The Nikkei Index, and financials in particular, have gained from the re-steepening of the JGB curve as long-term bond yields have been allowed to increase due to a less tight yield curve control. If Ueda’s flattens or even inverts the curve via hawking up the front, it will likely turn the tide on both Nikkei and USDJPY very swiftly leading to a swift disinflationary cocktail in Japan.

The problem with that directional view is that raising the front-end is equal to raising the long-end of the yield curve as we have seen clearly depicted in USD, EUR and GBP rates over the past couple of years. If the BoJ moves the needle on the policy rate, they will hence likely have to use CTRL+P to control the curvature again.

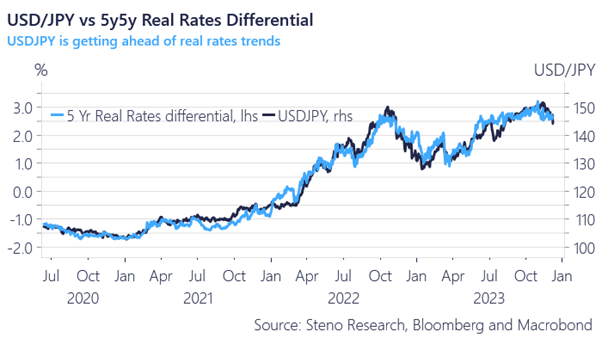

Is that really a structural JPY bullish feedback loop? Not as long as other central banks do not increase the balance sheet at least. USDJPY has moved a couple of big figures ahead of the real rates spread now and we see a reversal higher over the coming week.

Chart 1: USDJPY moving ahead of real rates here

US data surprises have started to soften, but given the oil demand, service sector price plans- and hiring intentions, it is safe to say that the slowdown is still well-hidden. European inflation is waning much faster than across the pond.

0 Comments