Something for your Espresso: The one on oil, inflation, and high betas

Good morning, friends.

Thanks to those of you who participated in our live Q&A session yesterday. We are thankful to the community that we have built. A post edited version will be released in case you missed it. Stay tuned!

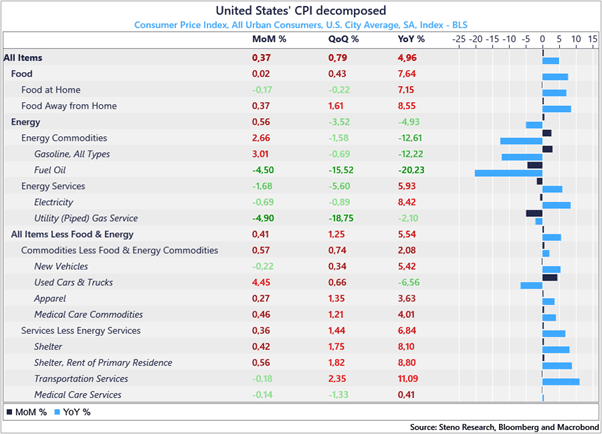

The CPI report made for very comforting reading for monetary policy doves and without the OPEC+ fueled temporary price spike in retail energy prices and a complete falsehood in used cars, this report would have smelled outright deflationary. Wage intensive categories such as transportation services and food away from home have now starting disinflating, which is truly good news for JPow. JPows proxy-favourite CPI measure (CPI core services ex shelter) printed at a mere 0.11% MoM.

We also know that both gasoline and used cars prices have corrected lower since the cut-off date of this data-print, which is why this report is massive food for doves. Interestingly, we have seen only a very moderate repricing of the EUR/USD spot, which is an interesting hint of an already extremely long positioning. We remain short despite USD disinflation.

Find out why below!

Chart 1: CPI decomposed. FOOD FOR DOVES

Weeeeehoooooooooooo! Inflation is finally truly waning, but have we forgotten about the reason why inflation is declining? Disinflation is only mana from heaven for so long and the USD funding market stress looms!

0 Comments