Something for your Espresso: Powell is gaining confidence, while Lagarde is losing it..

The Fed went from “needing a recession to lower inflation” to “no longer forecasting a recession” in under a year, while still seeing good odds of inflation returning to target. This is DOVISH as it is a consequence of the Fed being more upbeat on bringing inflation down without having to completely kill the labor market and the Manufacturing cycle.

Jay Powell also expressed some home that headline inflation slowing to 3% will pass through to expectations and broader inflation. These are slightly new tones in SHARP contrast to the consensus that core inflation leads headline. We agree with this take and proved it empirically here.

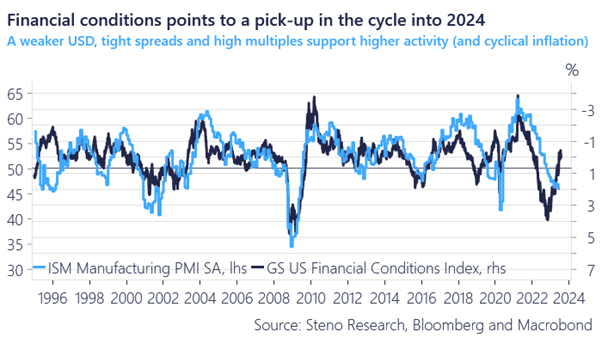

Chart 1: Financial conditions point to a cyclical rebound

The Fed is getting increasingly confident that they can orchestrate a soft landing as the recession is no longer a base-case for them. Meanwhile, ECB and Christine Lagarde are losing confidence by the week.

0 Comments