Something for your Espresso: No Russian spill-overs (yet) ahead of EUR-flation week

Morning from Europe

Everyone was on “risk premium” watch this morning when oil markets re-opened after a weekend of geopolitical turmoil. As we wrote yesterday, we don’t see any reason to get worked up over the geopolitical risks, even if a quiet palace revolt has increased in probability in Russia.

The area around the all-important oil-harbor Novorossiysk, the gas-flows via Turkstream and the prospects ahead of the renegotiation of Black Sea grain deal all seem relatively stable, but maybe Erdogan will manage to win a few concessions from Putin now that he backed him through the weekend? This is unlikely to be price bullish news for grains and energy.

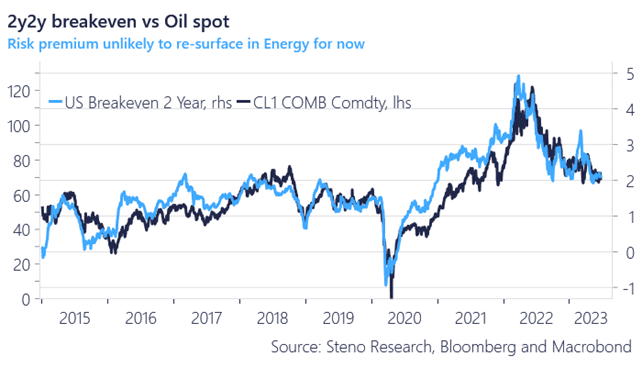

Break-evens and Oil prices will likely remain contained for now and the risk picture is likely pointing mildly downwards for both.

Chart 1: Oil vs. 2y2y break-evens

Benign opening after a volatile weekend with no signs of an increased risk premium in energy/grain markets, while bonds open bid. The inflation numbers will dictate the trends this week.

0 Comments