Something for your Espresso: No issuance bomb from Yellen

Morning from Europe ahead of a big data release day in the Euro area.

Before we get to the Euro area, let’s briefly touch upon the funding needs of the US Treasury. The quarterly refunding announcement was released late yesterday, and it made for relatively benign reading.

The recent economic strength has the Treasury lowering the borrowing expectations for Q1 by 55 billion vs the October estimate and it included relatively soft guidance on Q2 as well.

“During the April – June 2023 quarter, Treasury expects to borrow $278 billion (from January 2023)”

Compared to

“During the April – June 2024 quarter, Treasury expects to borrow $202 billion (From January 2024)”

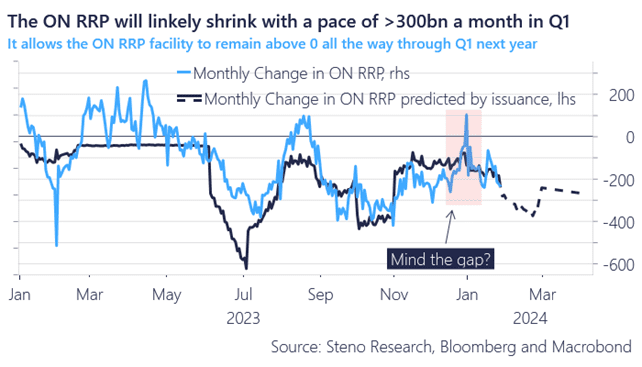

The overall conclusion is that the supply scare is fading in US Treasury space, while we instead need to focus on the technical ramifications of the issuance profile. The details on the issuance profile will be released tomorrow.

Chart 1: The ON RRP is still likely to be depleted before quarter-end

The risk of another supply-driven sell-off in USTs has diminished as the fiscal trajectory in the US is improving slightly due to an improving income side. Meanwhile, we have a big day ahead for the Euro area.

0 Comments